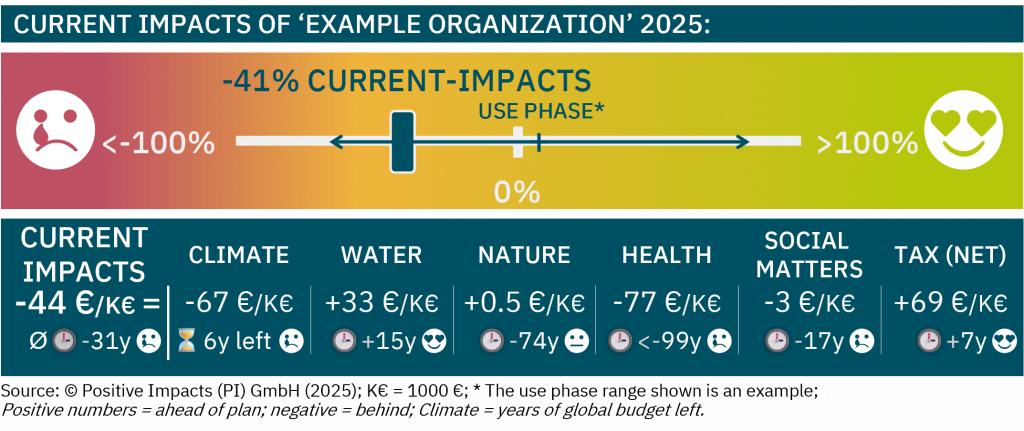

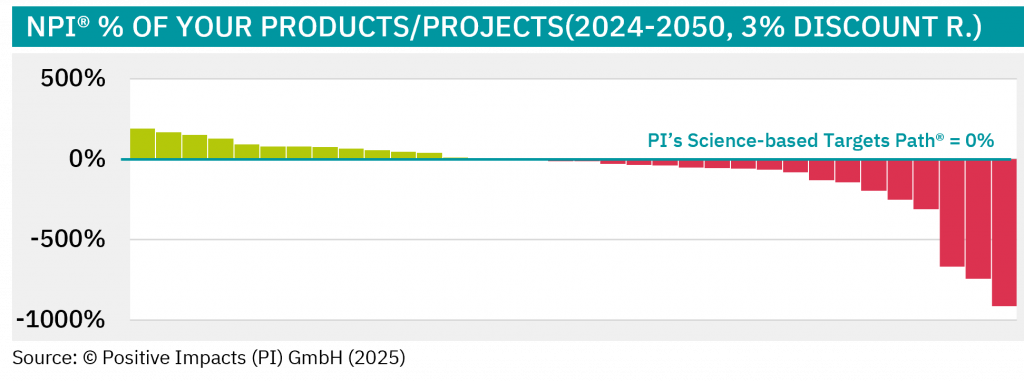

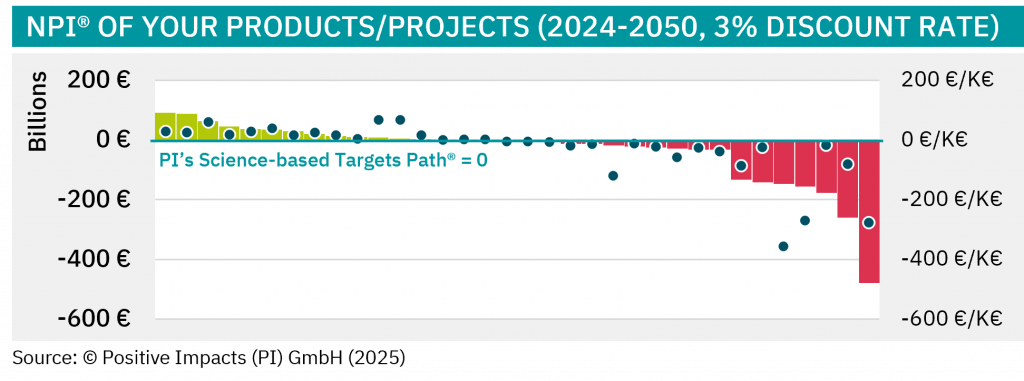

CURRENT IMPACTS of your organization — in % and €/k€

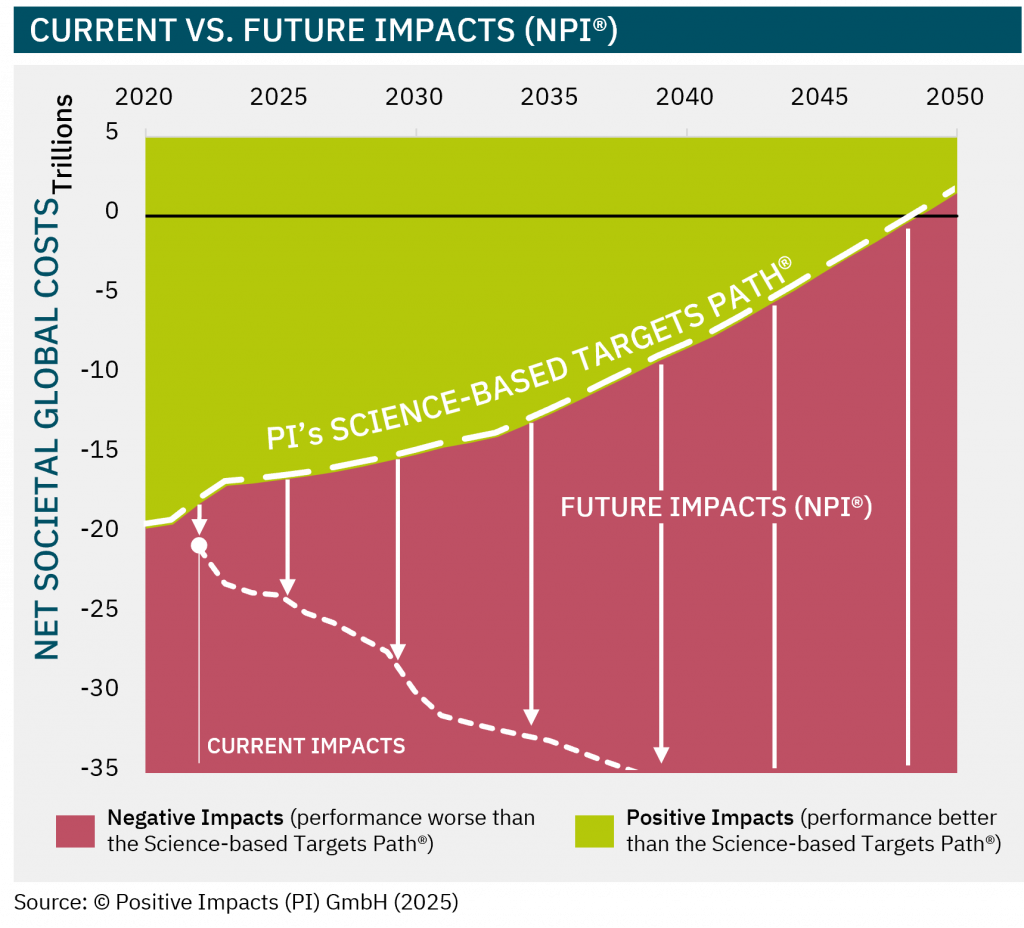

Current Impacts show how your organization is performing today compared to the expected level for the current year — both in percentage and monetary terms.

They quantify how close your current operations are to full alignment with the PI Science-based Targets Path®. They:

- Express performance as a percentage (−X % to +X %) and in monetary terms (€/k€), where 0 = full alignment

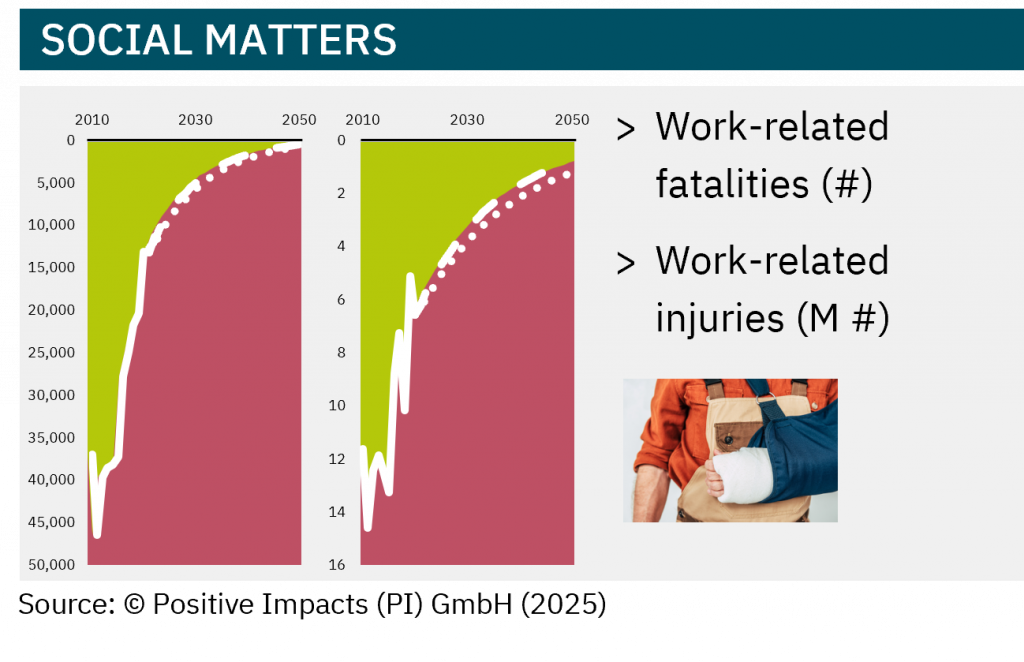

- Weight impacts by their severity, so more significant outcomes (e.g. a fatality vs. an injury) carry greater influence

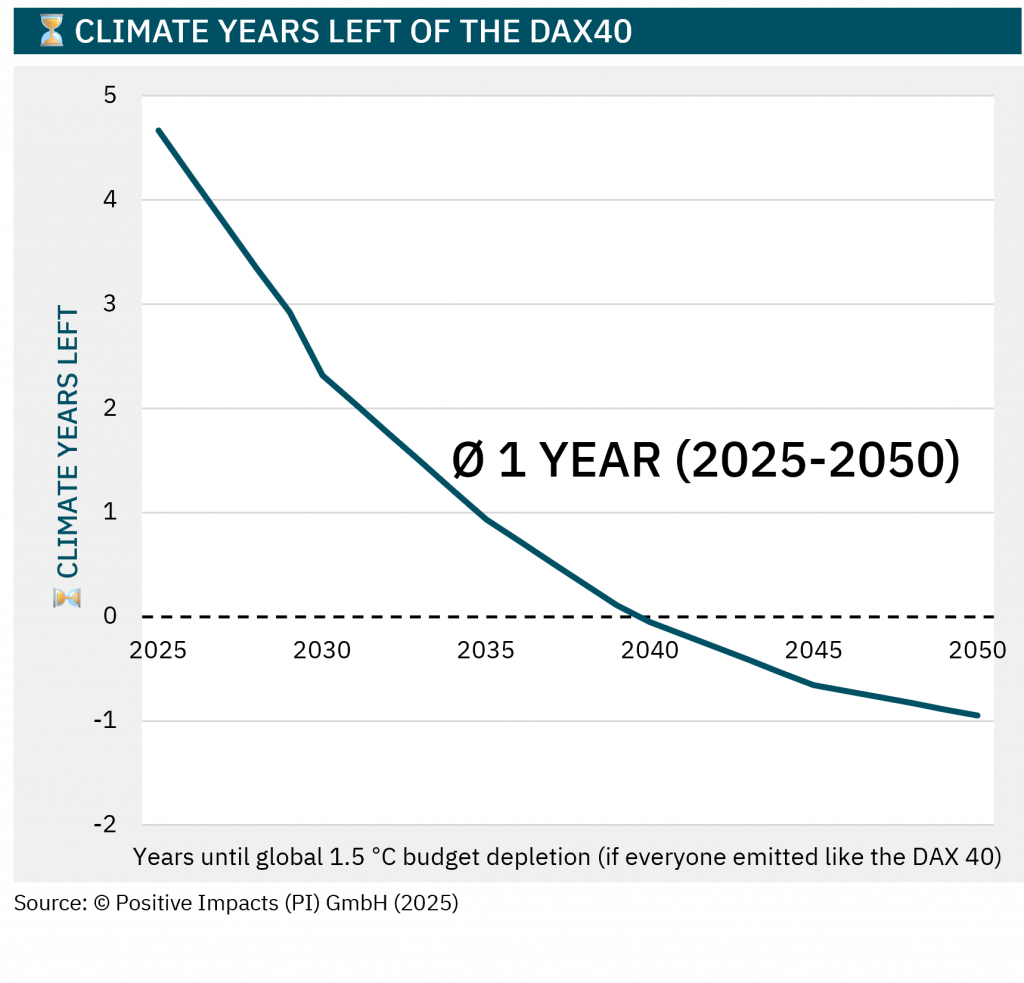

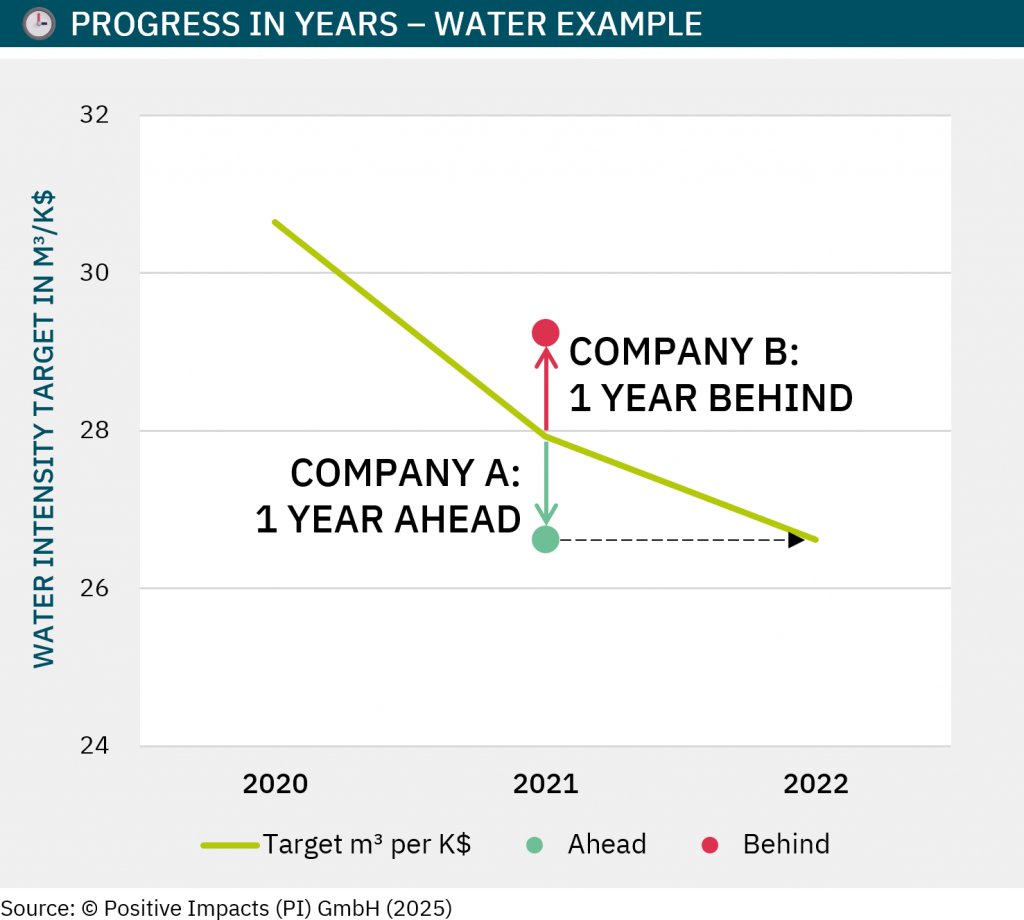

- Translate impact gaps into time — “Progress Years” show how many target-years performance is ahead or behind (see next tabs)

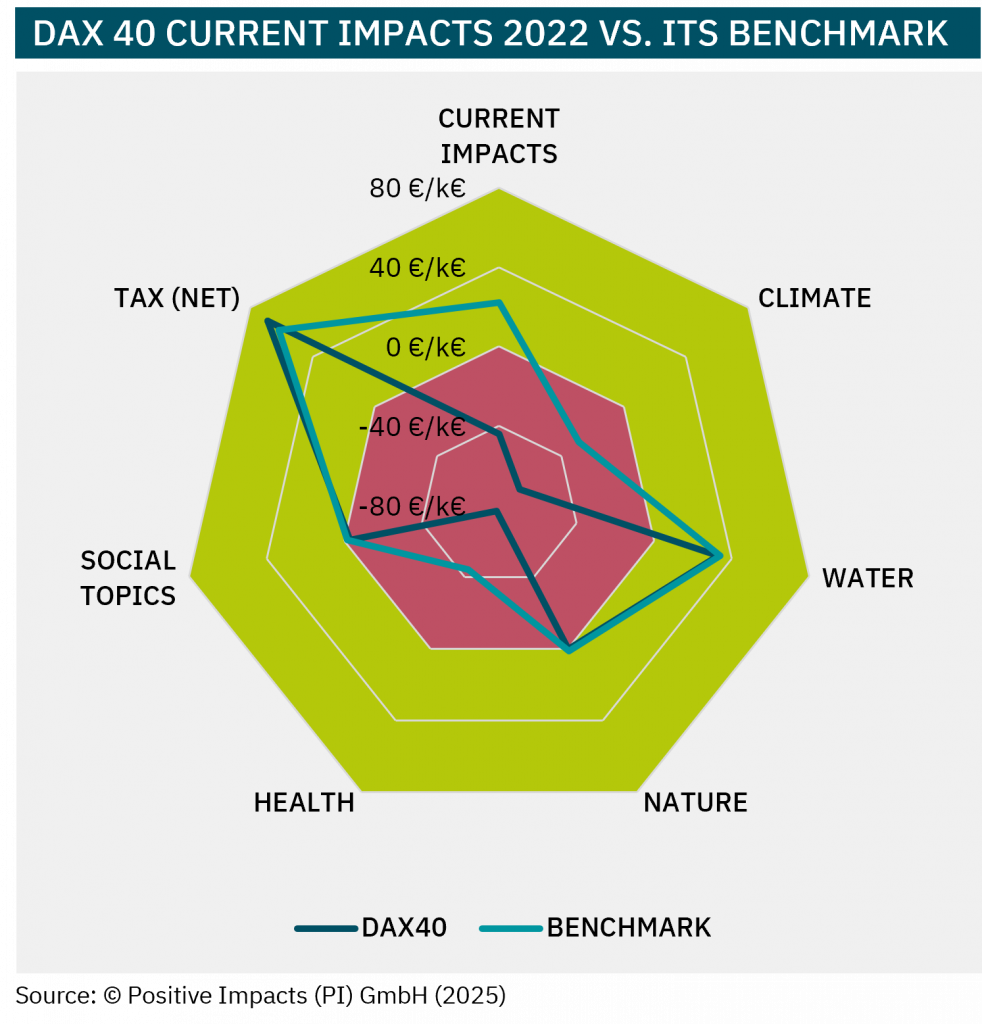

- Highlight strengths and gaps, helping you prioritize what matters most

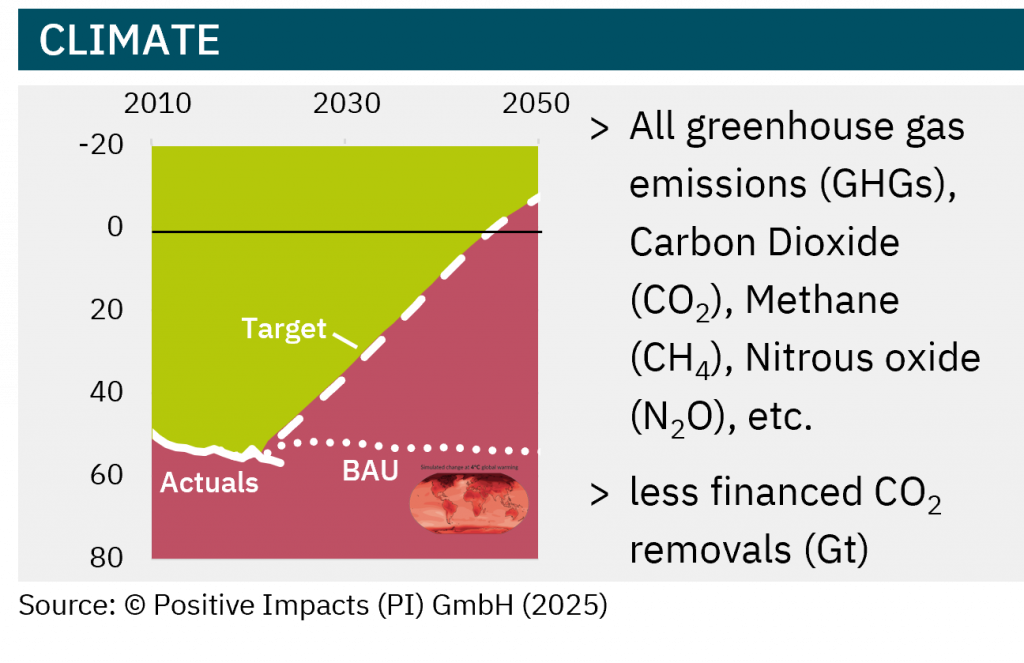

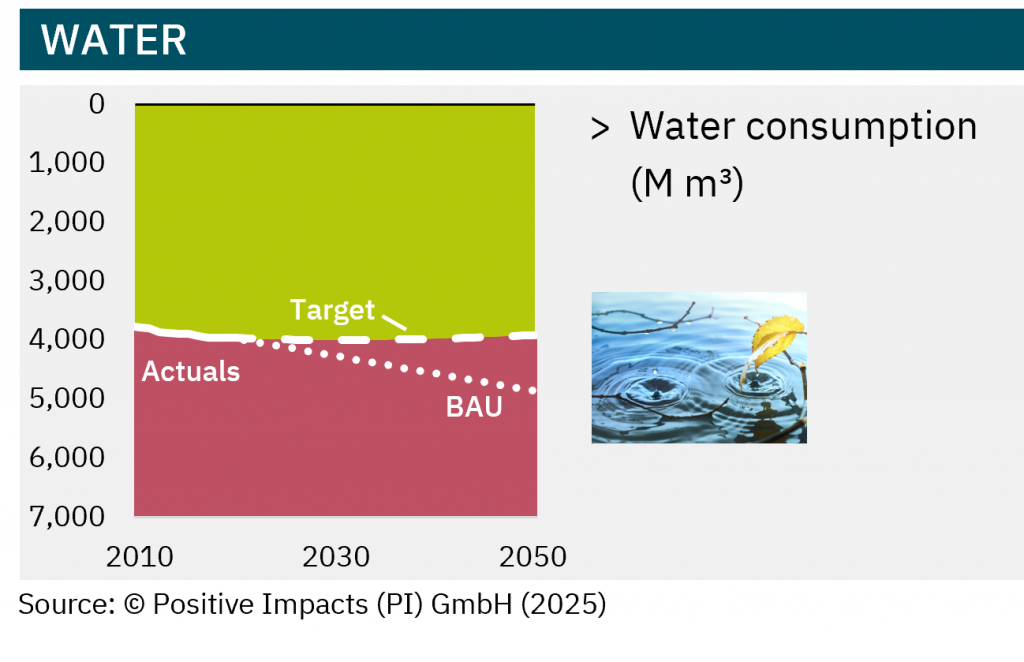

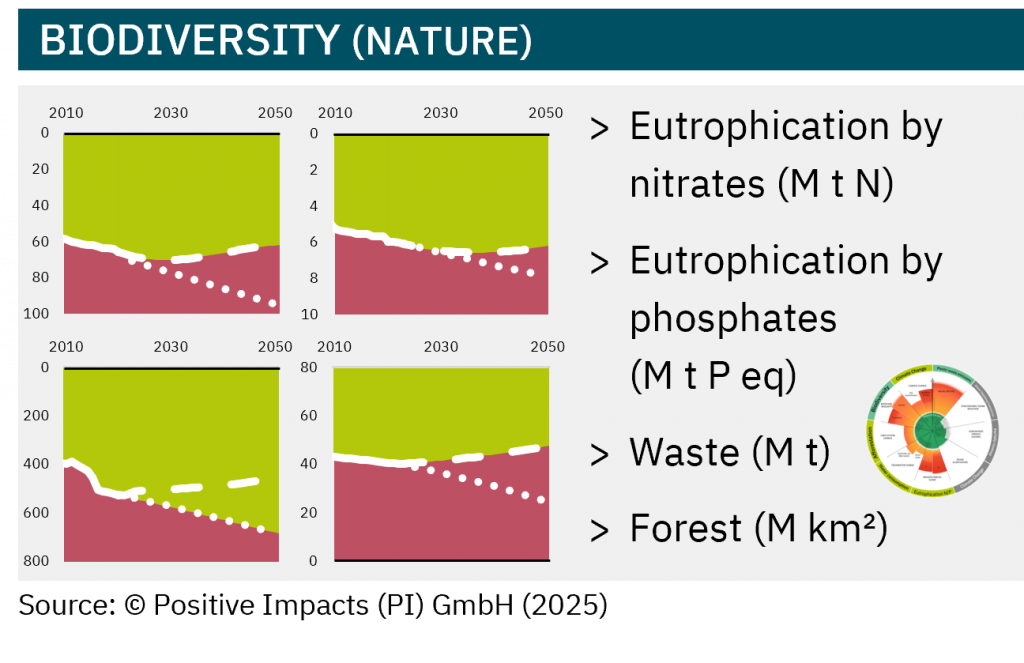

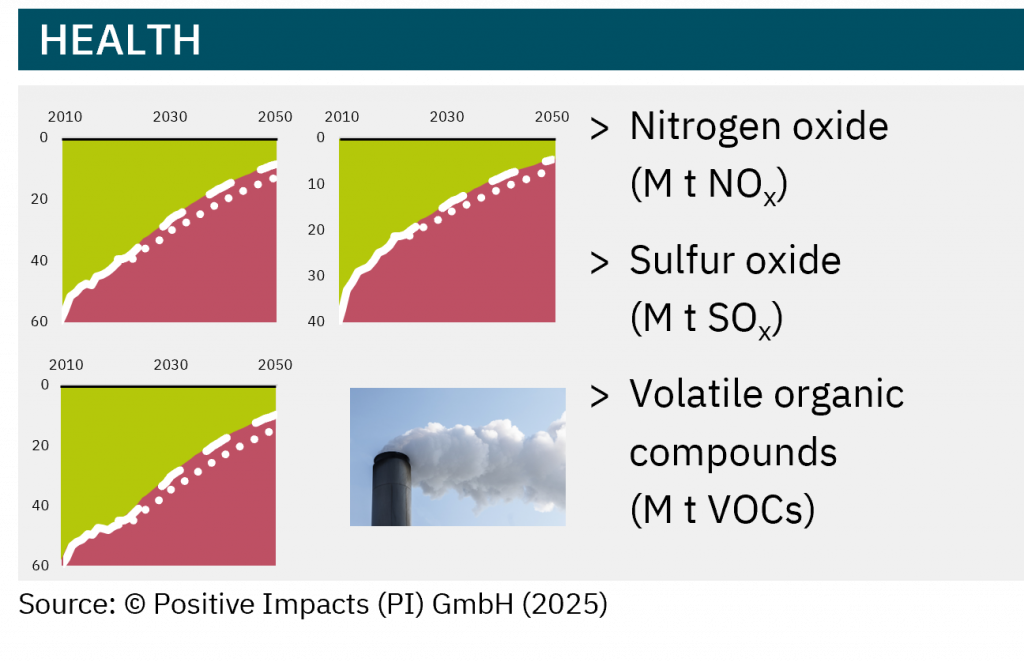

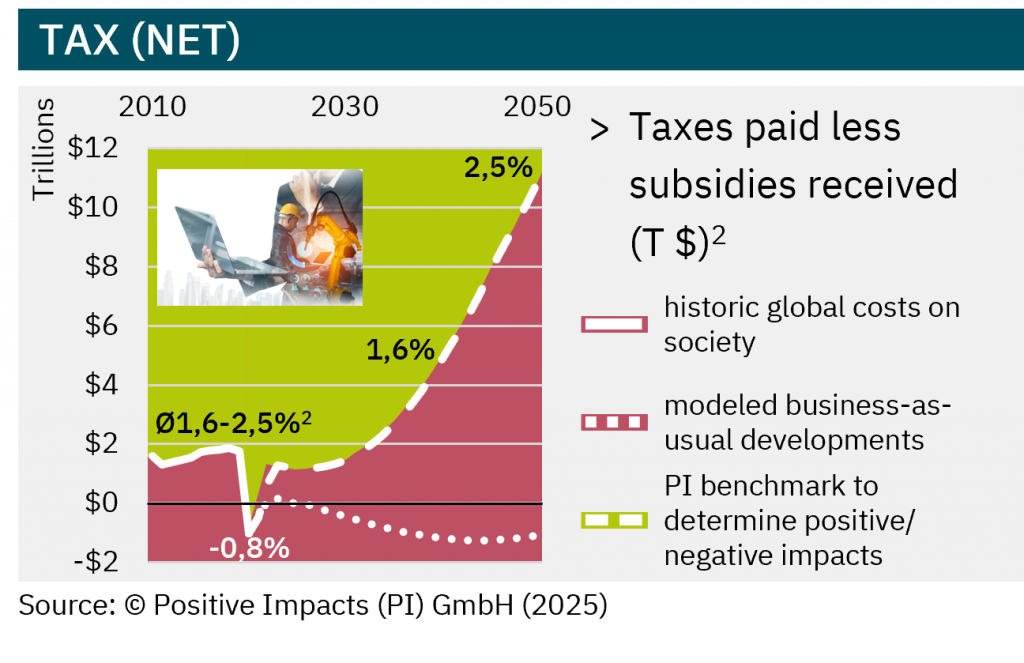

- Aggregate results across six topics: climate, water, nature, health, social matters, and net tax

- Enable benchmarking across sectors, activities, products, and value chains

- Uses an open-ended scale, capturing both positive and negative net impacts

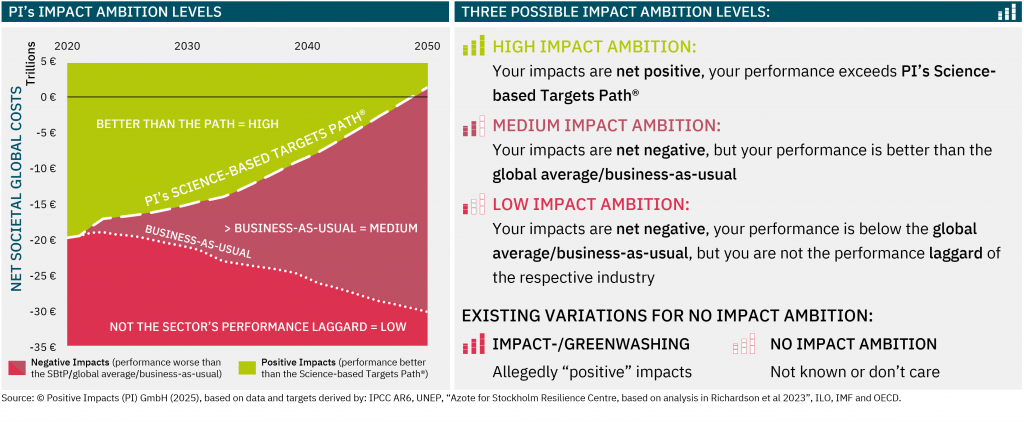

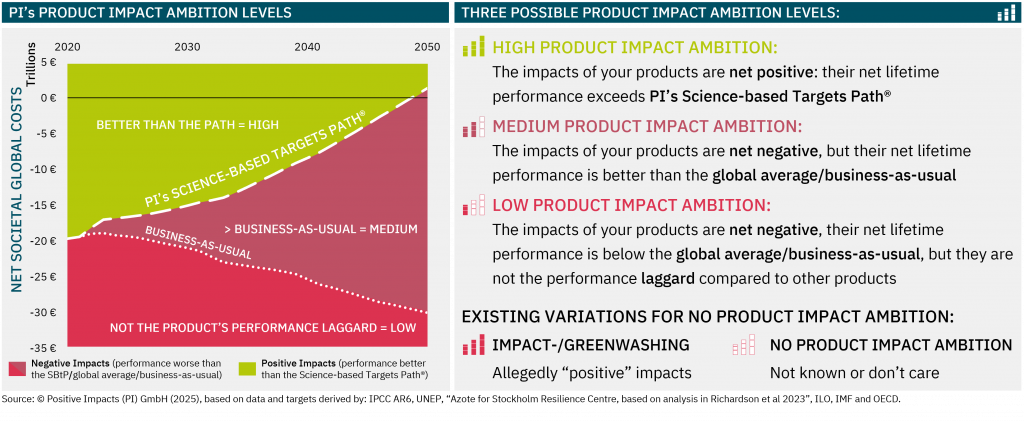

After quantifying Current Impacts, your sustainability performance is classified into three Impact Ambitions — high, medium, or low.

These ambition levels reveal how your organization compares to the PI Science-based Targets Path® and to the global average, showing at a glance whether you are leading, aligned, or falling behind.