Evolution of Materiality & Frameworks

Duration Lecture: 2 hours (+ pre-recorded 30–45 min & 1-hour deep-dive/Q&A)

Learning objectives:

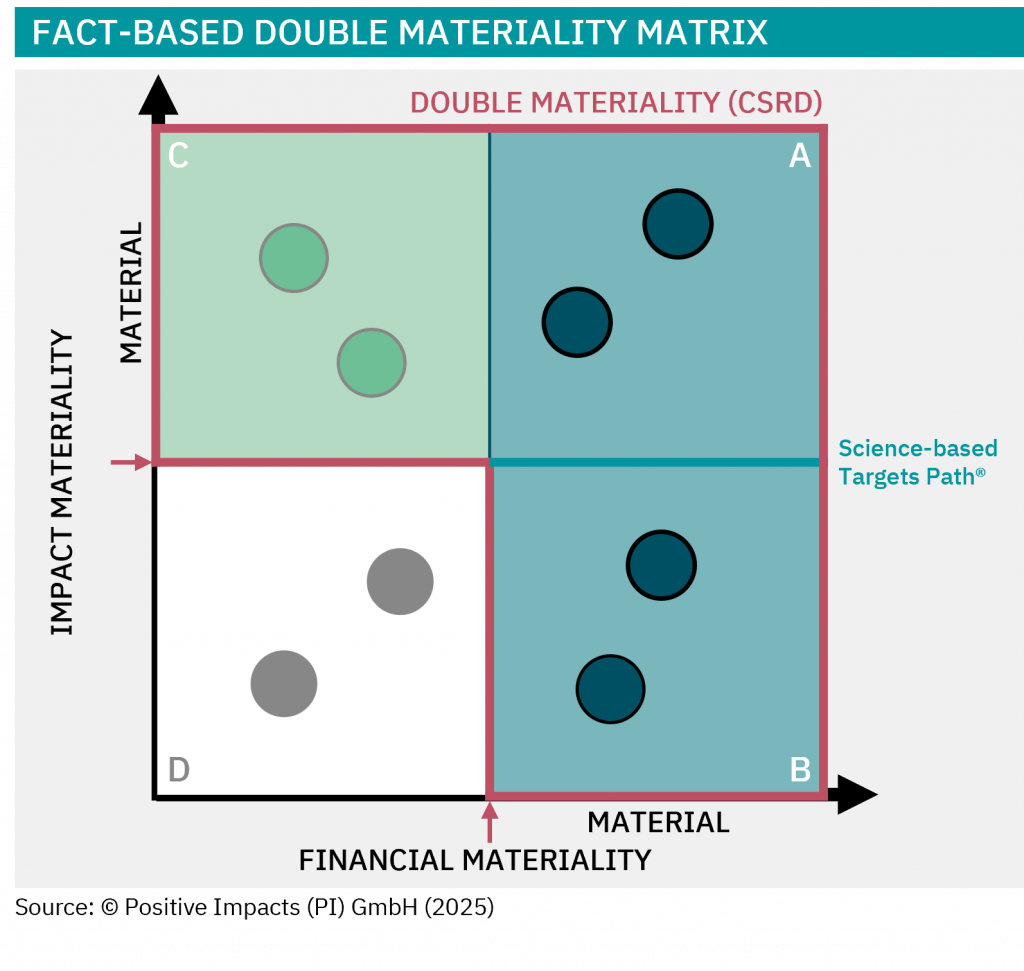

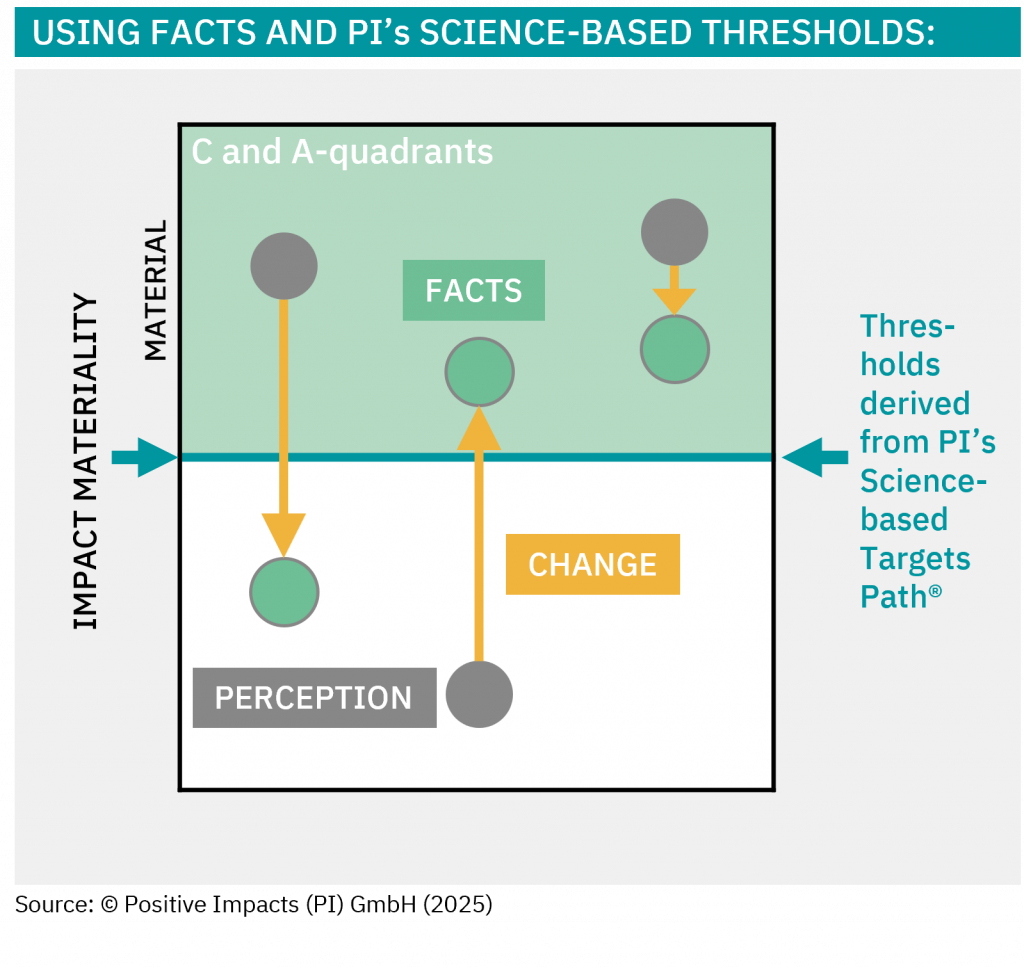

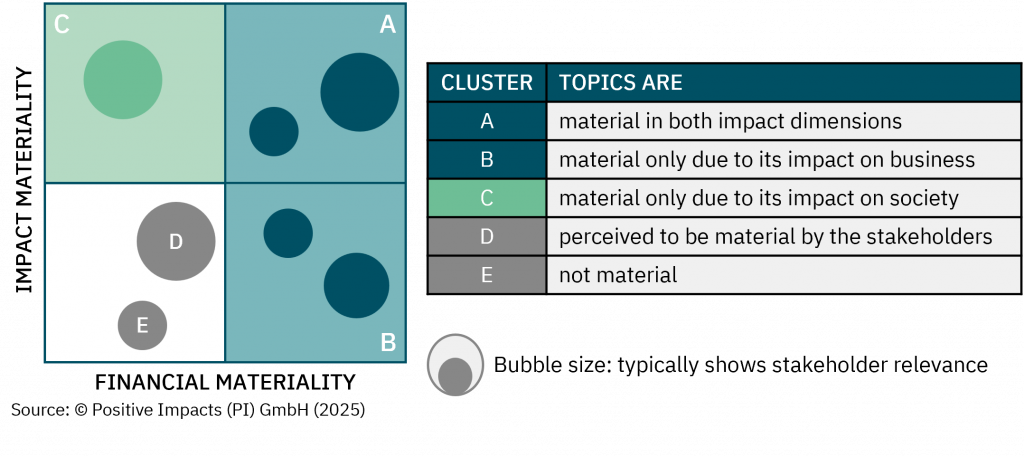

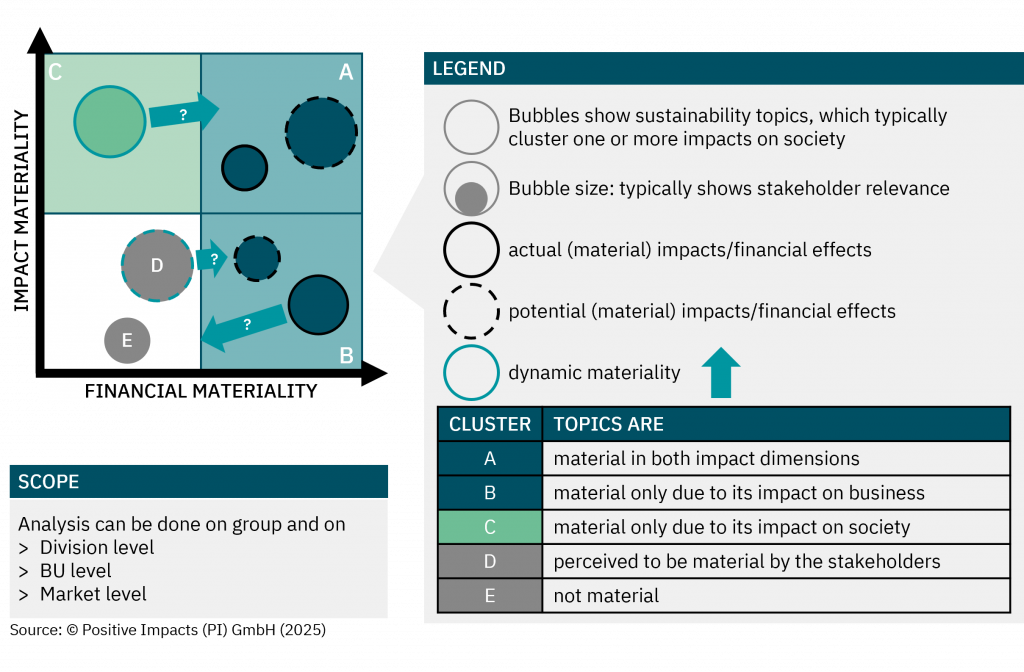

Understand the evolution from financial materiality to double materiality.

Distinguish between assessment and definition of materiality.

Compare major frameworks (CSRD/ESRS, GRI, ISSB/SASB, TCFD, TNFD).

Key takeaway: how frameworks differ from each other and which ones are most interesting for your organization