This article was originally shared in our Newsletter — B-Day 2024.

Subscribe here to receive future updates.

The Positive Impacts newsletter — Birthday edition 2024

In this edition: PI’s Science-based Targets Path® · CSRD Data-Driven Double Materiality · COP29 Special Report · New Advisory Board Member · Publications & Presentations · BVMW Commission role

Our newsletter is also available in German. To receive updates in German, you can adjust your preferences or email us at

info@positive-impacts.com.

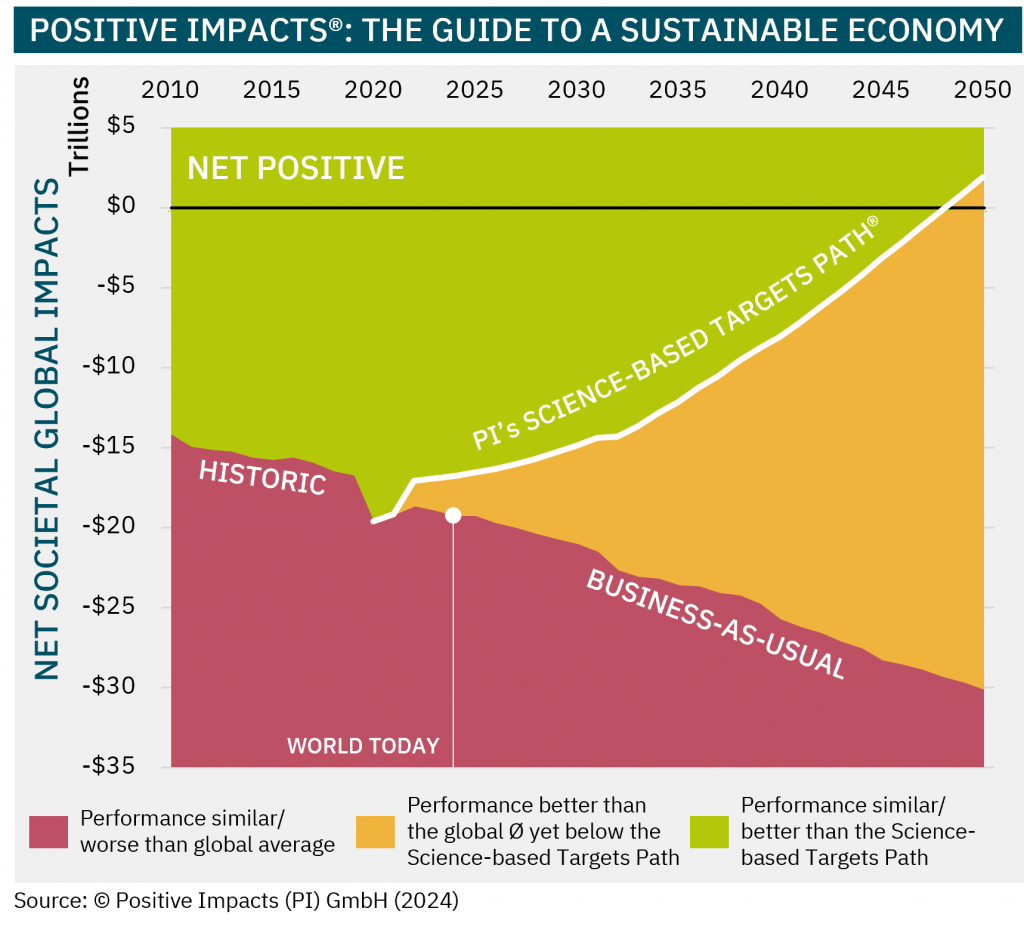

Birthday Special: PI’s Science-based Targets Path®

We further developed and simplified our holistic model and pilot-tested it on the DAX40.

- Holistic guide for organizations, investors, and consumers to a sustainable global economy by 2050, using data and targets from IPCC AR6, UNEP, Stockholm Resilience Centre, ILO, IMF, and OECD.

- Evaluates any economic activity on its contribution in % and monetary terms (€, $, ¥) — PI’s context-based impacts valuation.

100% & 0 € = aligned with the Science-based Targets Path®; >100% / >0 € = better; <100% / <0 € = worse. - Assesses current contribution and forecasted contributions via present value (NPT® in %, NPI® in €, $).

- Enables peer benchmarking and decision-making on desired contribution levels.

- Optimizes choices on preferred topics (e.g., climate) while showing trade-offs on other topics.

- Impact-washing-resistant via clear accounting rules (no hiding in supply chains or behind false “positives”).

And why is this a birthday special? Because we just turned 4. 🎉

CSRD Application: Data-driven Double Materiality

Revolutionizing double materiality with a quantitative, data-driven approach that aligns with CSRD requirements and science-based thresholds.

- Addresses limited stakeholder knowledge by starting from facts.

- Ensures a complete impact view.

- Uses science-based thresholds.

- Prevents sunk costs and reduces risks.

- Data-driven by design.

Read more in our LinkedIn post and discover how thresholds guide assessments.

LinkedIn Live: Data-driven materiality

15-min presentation + 30-min Q&A

German session: Nov 20, 12:00 CET · English sessions: Nov 21, 08:00 & 16:00 UTC

What COP29 should (not) learn from Corporate GHG Accounting

Financing the transition should follow “who pays decides.” Our special report includes a scenario of the DAX40 carbon-neutrality gap.

- Corporate GHG accounting should also consider purchased emissions.

- Countries should include imported emissions and exclude exported ones.

- Read more on the “who pays decides” principle in our COP29 Special Report.

New Advisory Board Member: Torbjörn Hamnmark (WWF & Mistra)

Torbjörn Hamnmark is an experienced investment strategist. Since 2014 he has served as Head of Strategic Asset Allocation at the Swedish National Pension Fund AP3 (USD 50 bn), and is a board member of WWF Sweden and on investment committees for Mistra.

Publications & Presentations

Lead article in ESGZ: “ESG KPIs: Dangerously indispensable helpers” (with Prof. Dr. Wolfram Heger). Obtain your copy from the publisher.

Project meeting of BMBF-funded “ClimLabels” (Ruhr University Bochum)

Advisory contributions and presentations on transition finance working papers, including PI’s Science-Based Targets approach for positive impacts.

Presentations

• Circular Valley Partner Talk: “Sustainable company valuation” — risks/opportunities of new EU reporting, holistic assessment for resilience, and opportunity evaluation.

• VMV General Assembly (Metal Packaging Association): CSRD — integrating sustainability/ESG into strategy, processes, and reporting.

BVMW: Deputy Chairman of the Commission for Energy & Sustainable Management

In the commission, SME leaders develop solutions to advance the energy transition and spread sustainable business. PI has been a BVMW member since March 2021 and contributes within the sustainability expert network, including drafting position papers.

Website