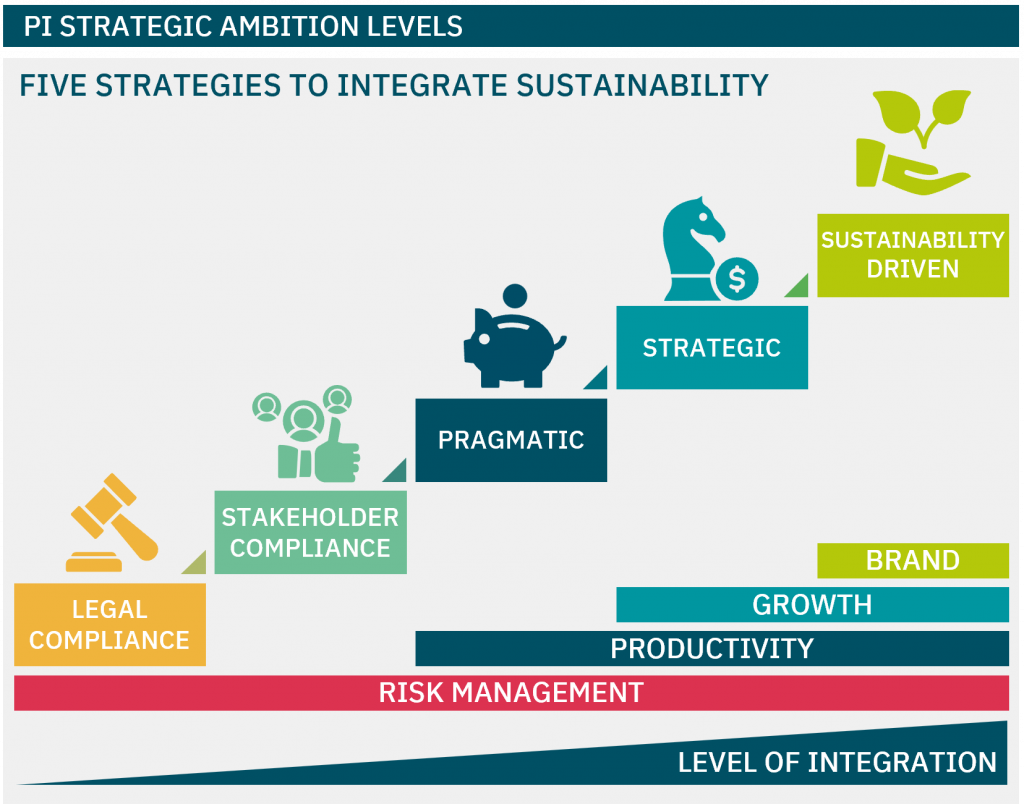

Embedding sustainability into investment strategies

for investors

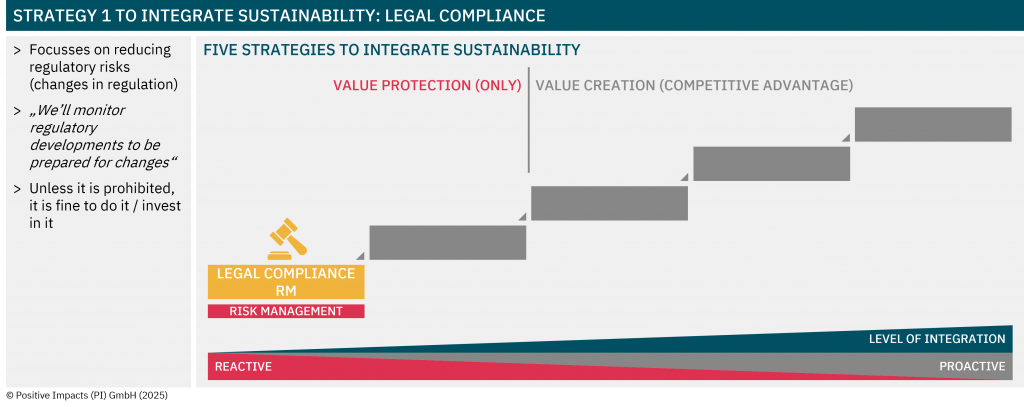

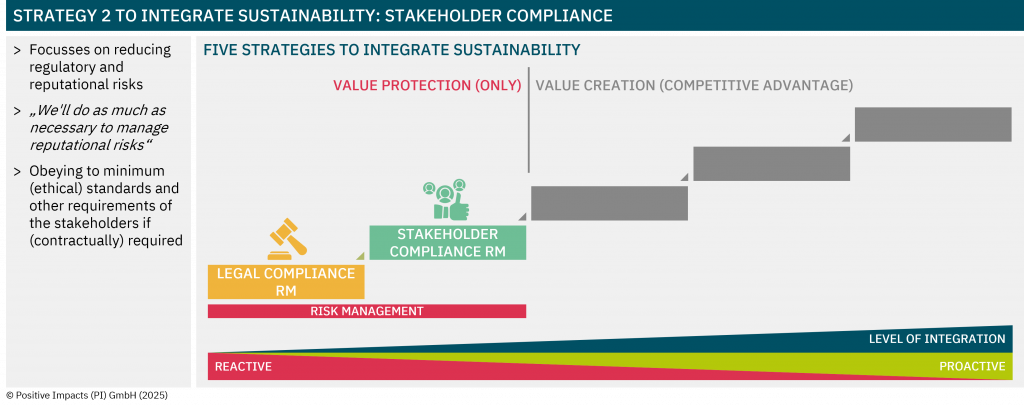

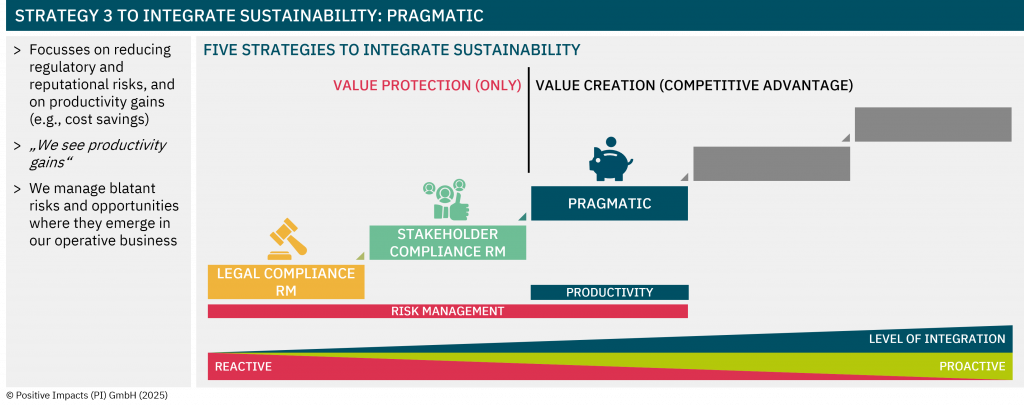

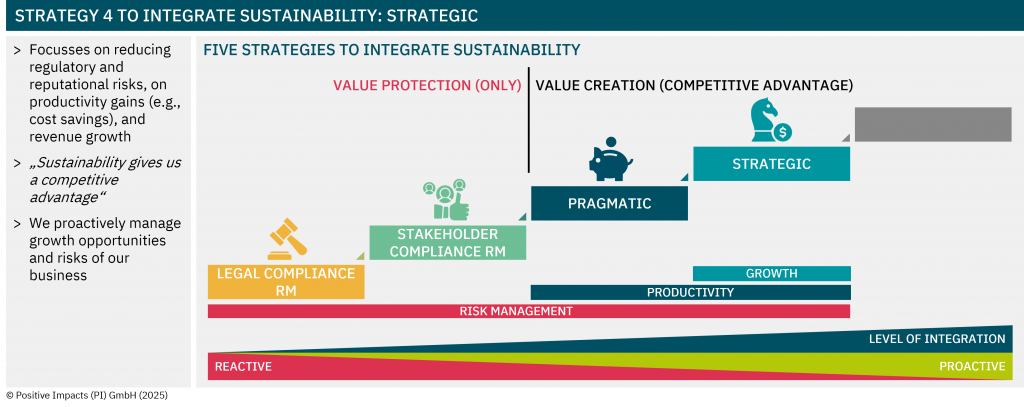

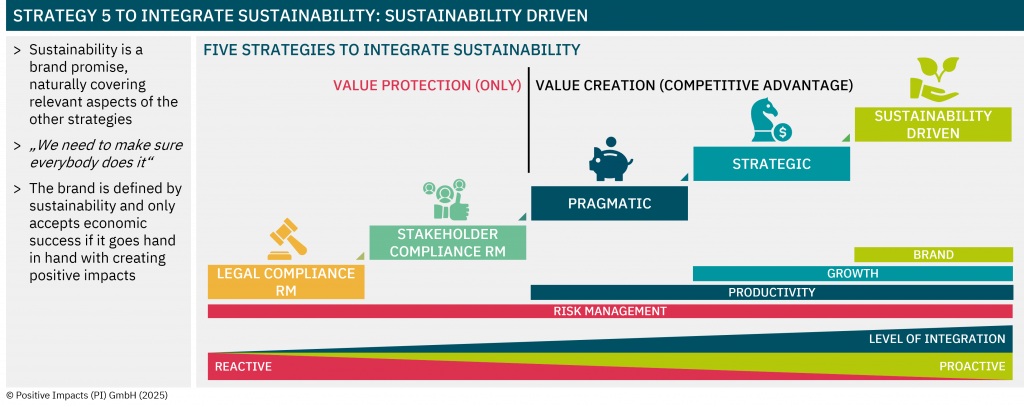

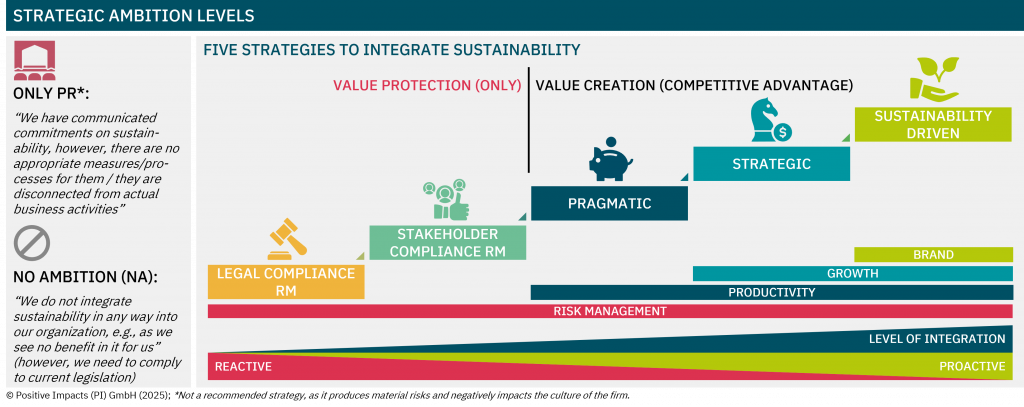

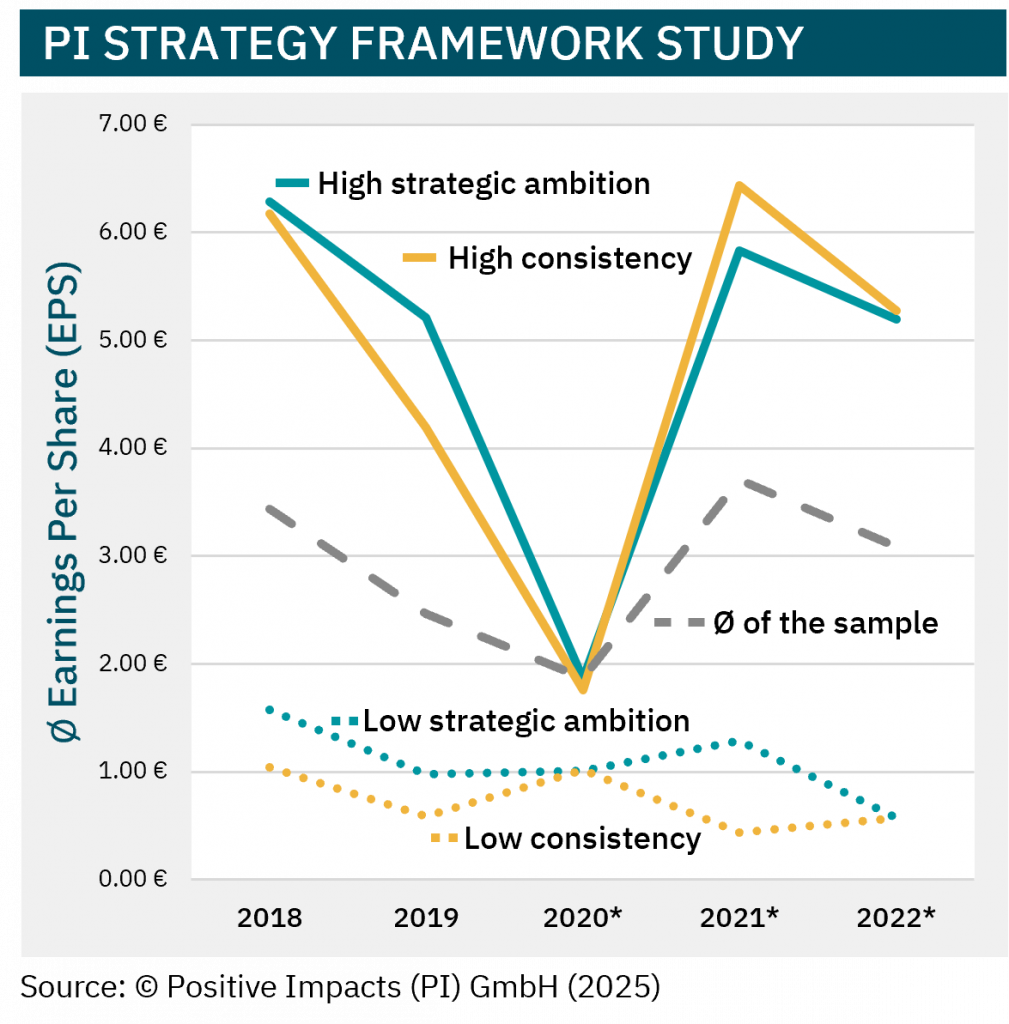

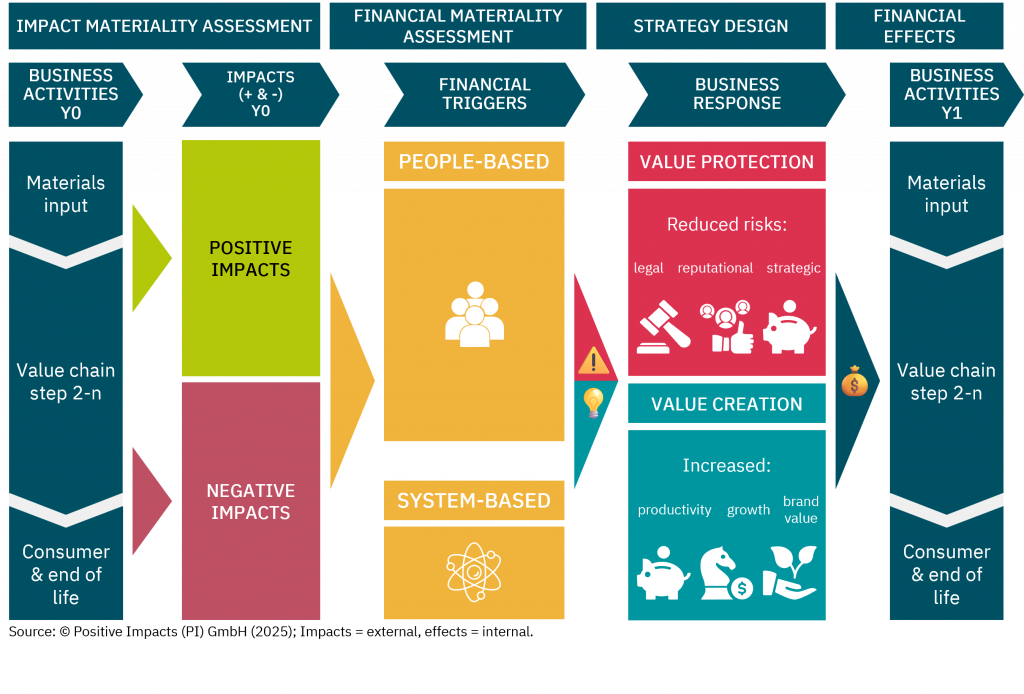

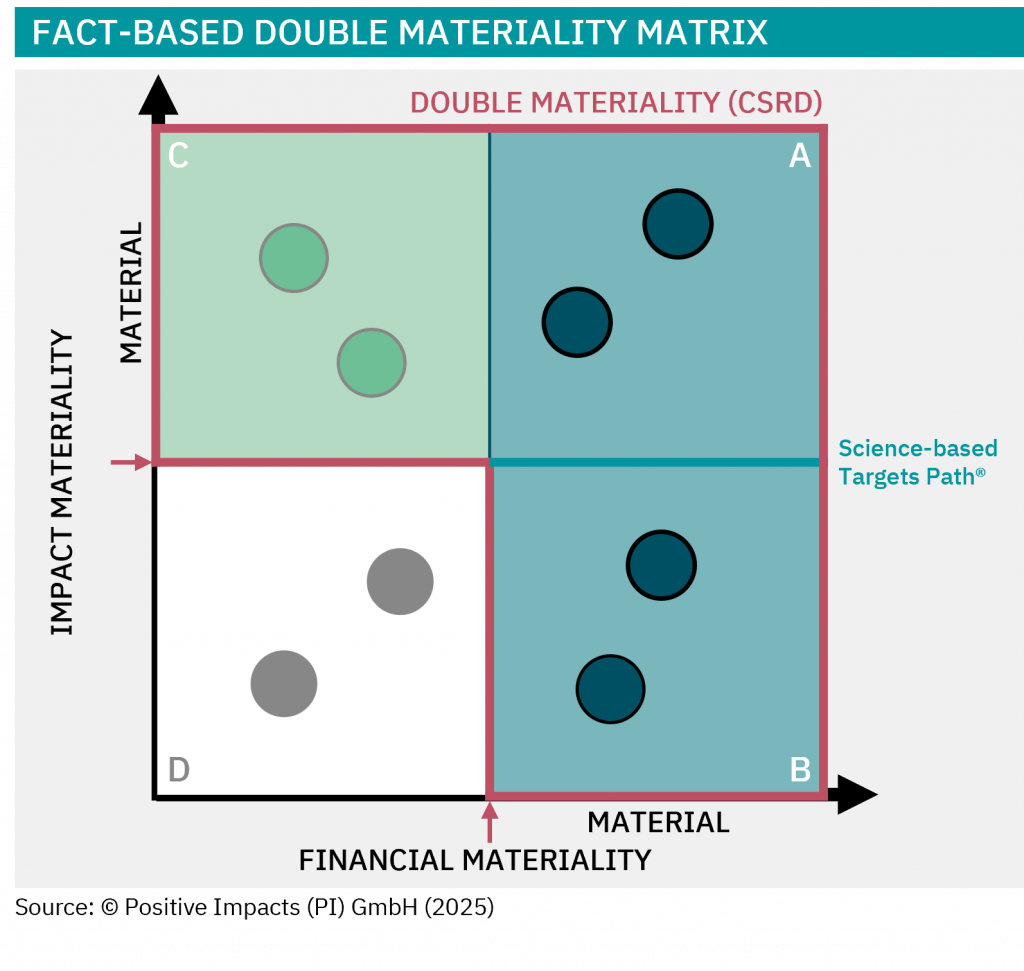

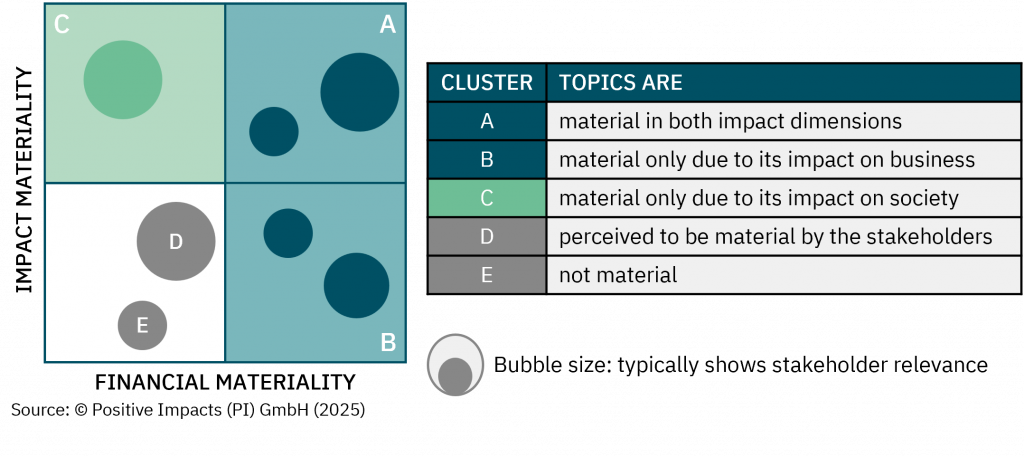

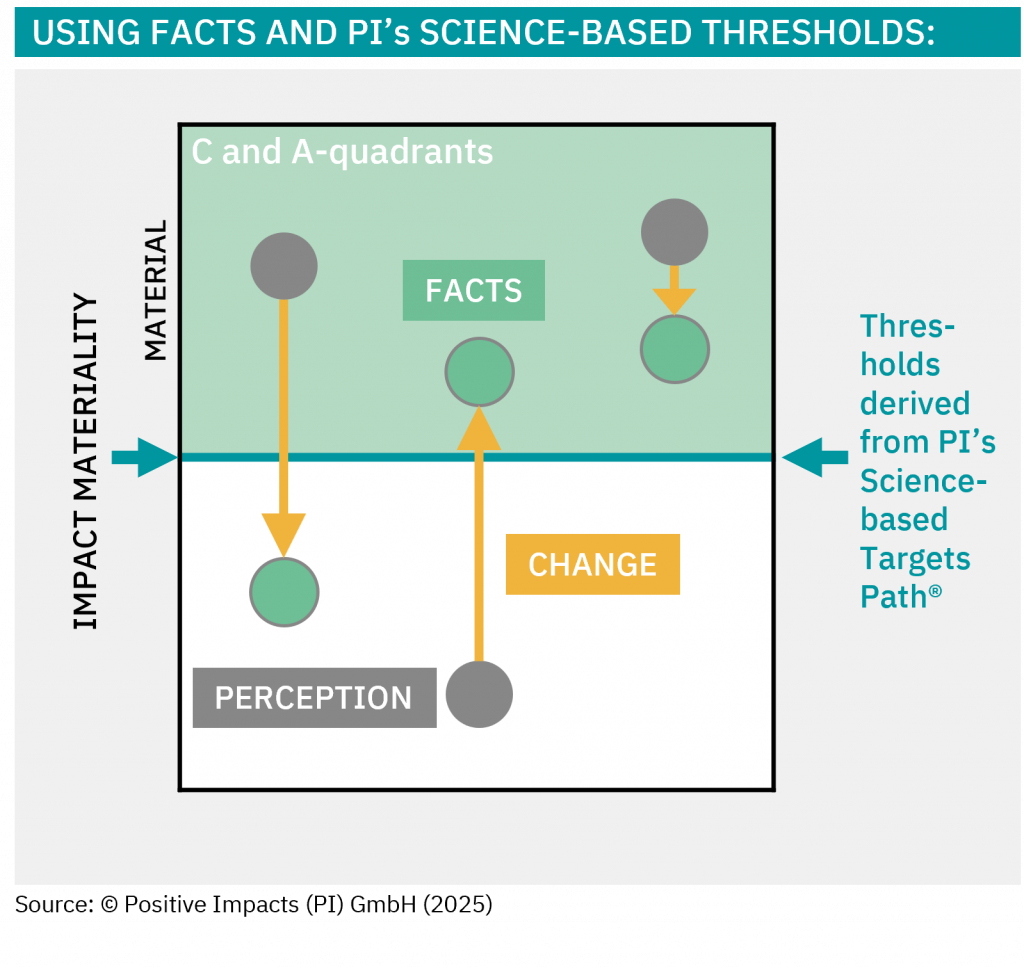

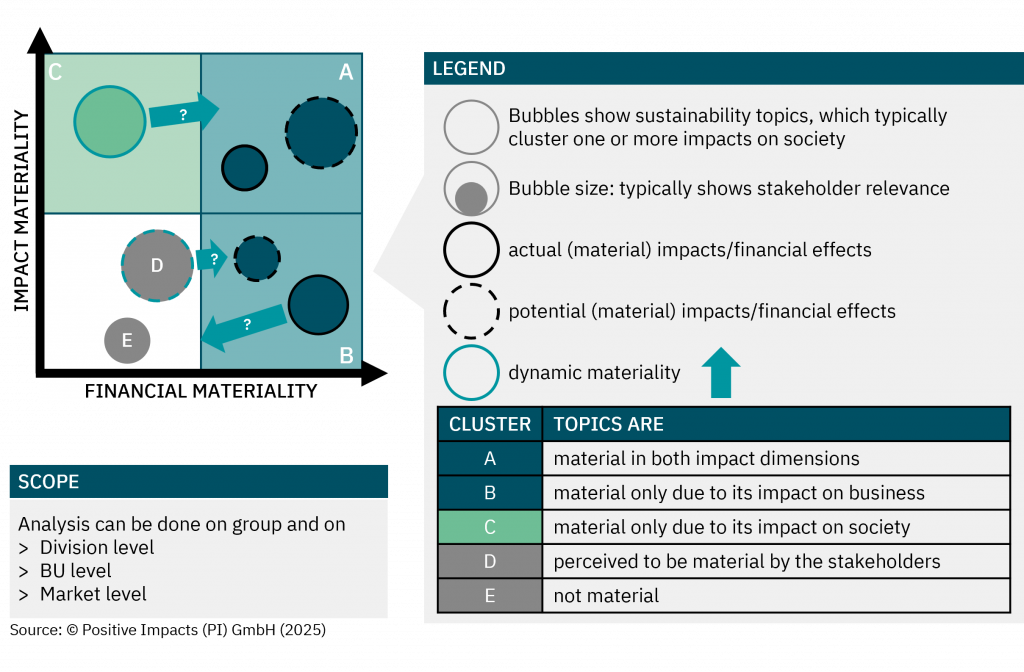

Our framework enables investors to evaluate the strategic sustainability approach of portfolio companies and potential investments. Apply one consistent methodology across firms, compare ambition and management quality, and identify risks and opportunities.