The steps

Coming soon:

Professional trainings for materiality

How materiality provides direction

Done right, materiality converts noisy stakeholder input and scientific thresholds into a clear plan of action. It shows which sustainability issues drive financial risk or create measurable value, where to focus data collection, which KPIs to track and what the Board needs to decide. The result: prioritised workstreams, board-ready metrics and a defensible evidence trail for reporting and investor dialogue.

Impact Materiality made measurable

Impact Materiality assessments are the basis of any sustainability strategy and governance. We combine quantitative approaches with feasible stakeholder input to assess the positive and negative impacts of your organization on society and the environment.

Our methodology includes:

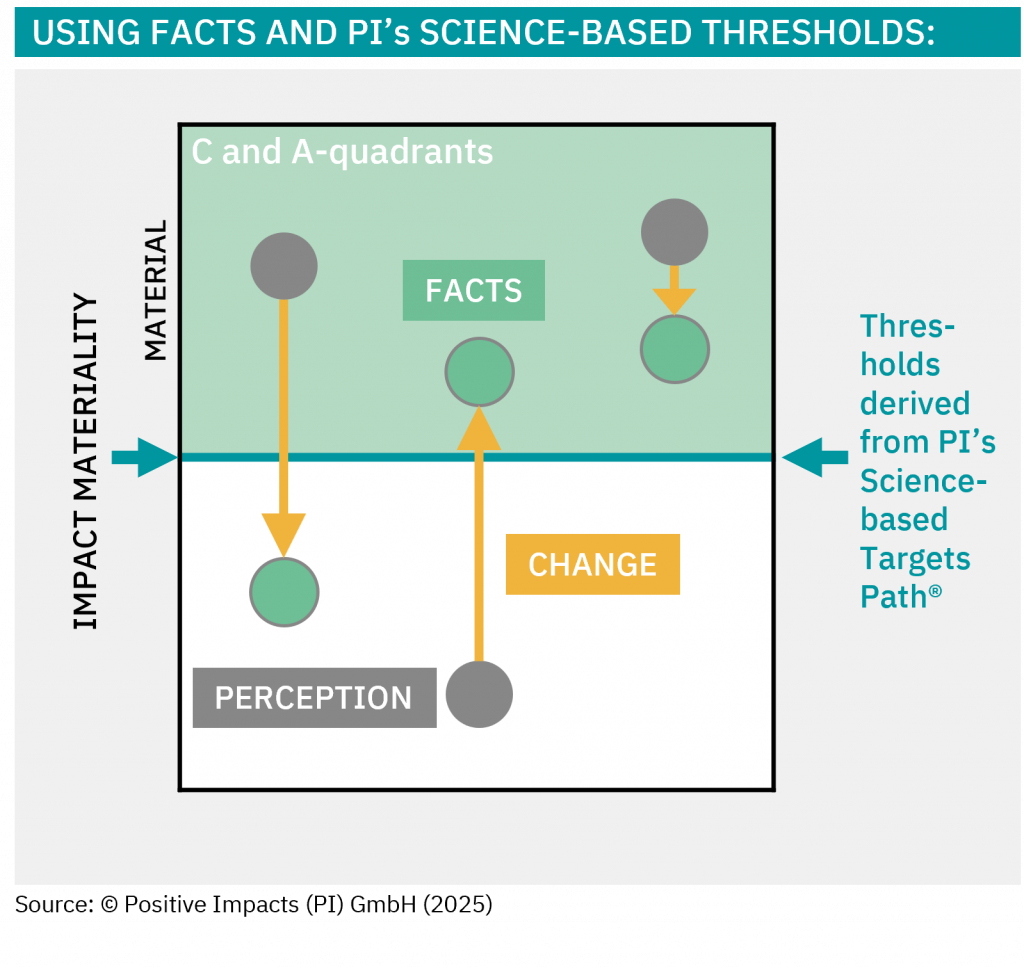

- Scoring on a scale that you choose, where we map our science-based thresholds for climate, water, nature, and social topics to your chosen cut-off

- Integration of stakeholder perception and expert input

- Tailored approach that best fits the maturity of your impact materiality processes

- Alignment with CSRD’s double and a useful input for IFRS’s single materiality requirements

This ensures that your impact materiality assessment is not just compliant (if relevant), but meaningful. It helps you prioritize actions, allocate resources, and communicate with confidence.

Under CSRD, not only missing out material impacts, but also the reporting on non-material topics is non-compliant. We help you get it right – what to focus on – and go beyond.

use impacts for csrd-reportingfinancial materiality

Financial Materiality made measurable

Financial Materiality assessments are the basis of any (sustainability) strategy and governance. We connect quantitative approaches for Impact Materiality, with our expertise on how these can already be or become financially material with feasible stakeholder and expert input on your side to assess how sustainability topics affect your financial performance.

Our methodology includes:

- Scoring on a scale that you choose, where we help you translate the risk appetite of your CFO to the cut-off for financial materiality

- Integration of stakeholder perception and expert input

- Tailored approach that best fits the maturity of your financial materiality processes

- Alignment with statutory, CSRD’s double and IFRS’s single materiality requirements

This ensures that your Financial Materiality assessment is not just compliant to both your statutory and (if relevant) sustainability reporting requirements, but also meaningful. It helps you prioritize actions, allocate resources, and communicate with confidence.

Under CSRD, not only missing out material impacts, but also the reporting on non-material topics is non-compliant. We help you get it right – what to focus on – and go beyond.

Translate materiaity to value and risksthe process

From materiality to strategy – turning insights into action

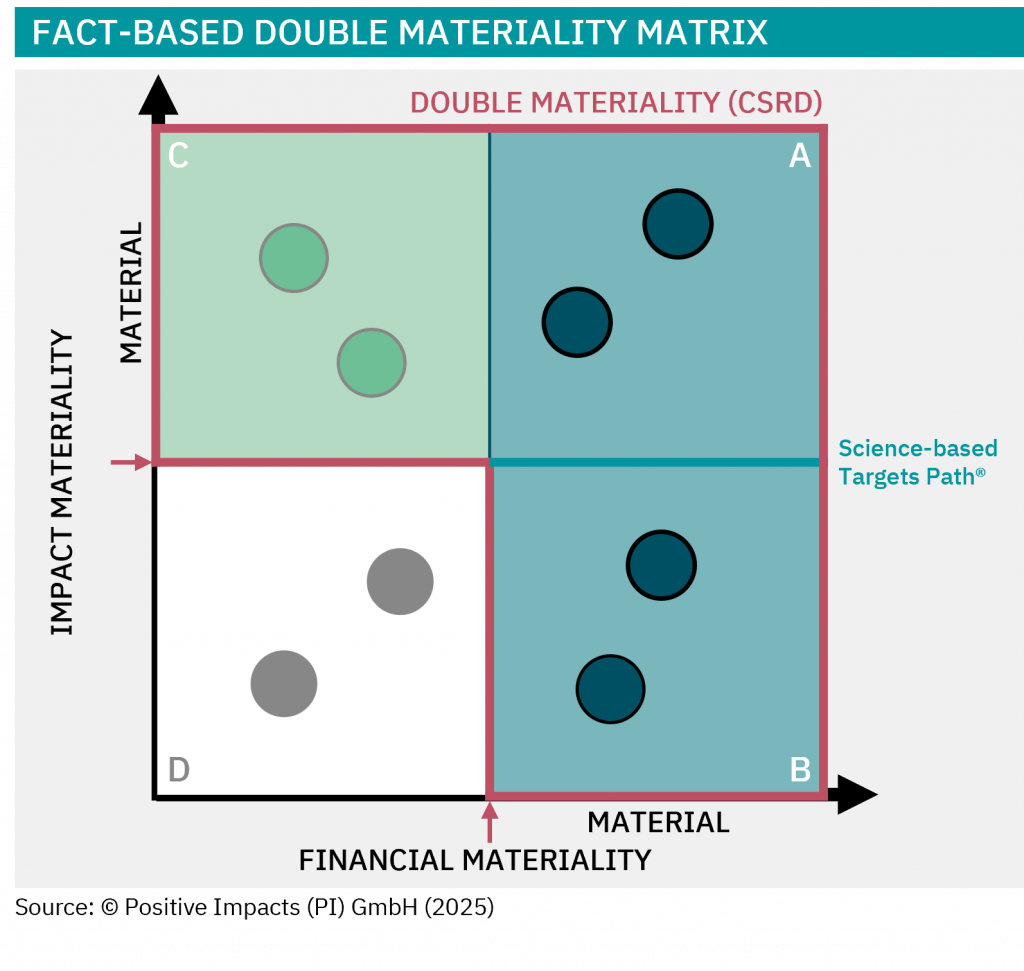

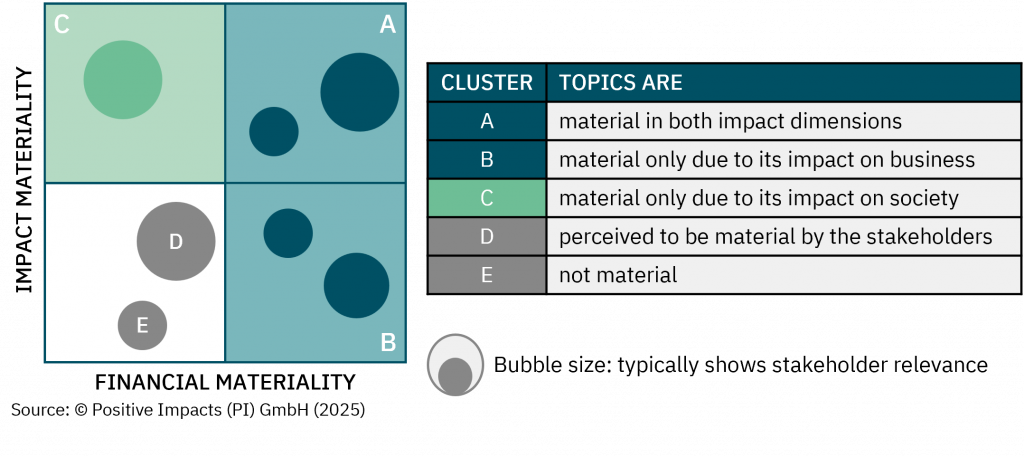

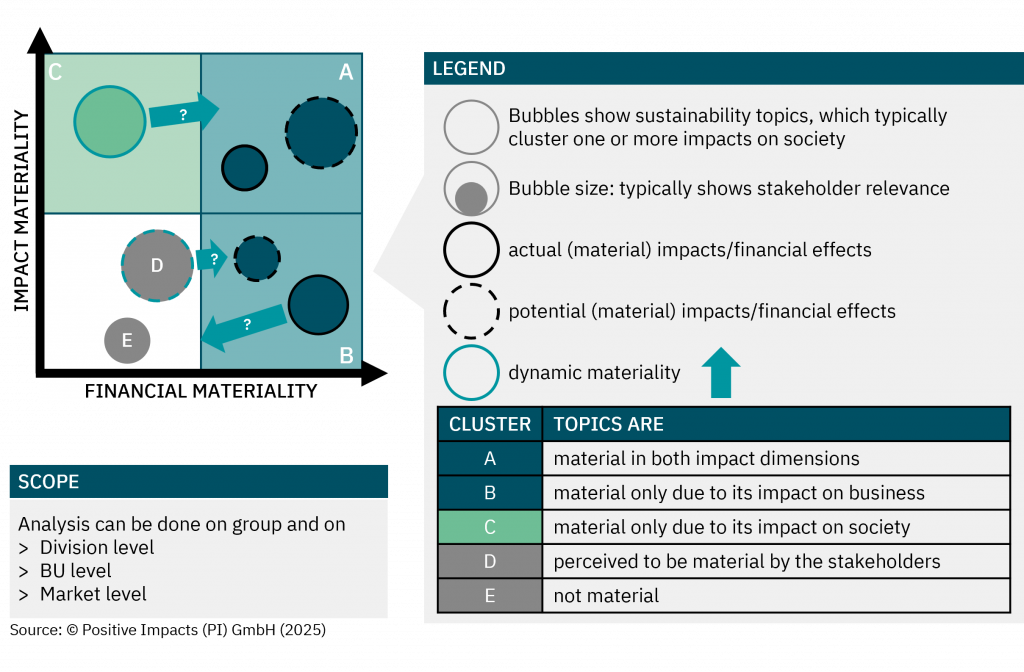

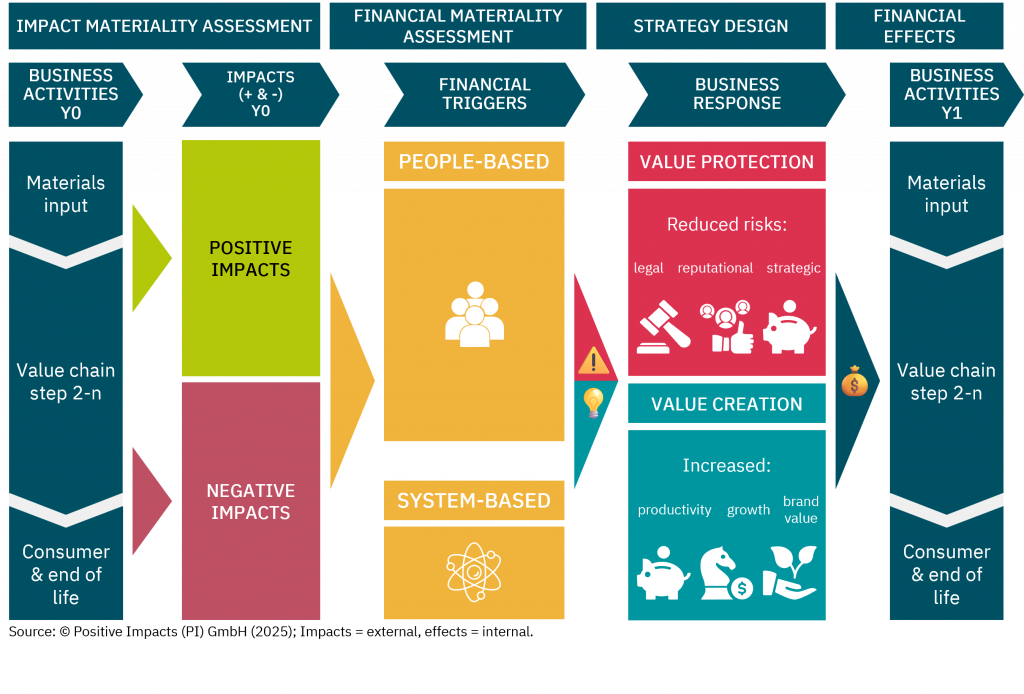

The process of combining quantitative impact analysis with stakeholder and expert insights to determine both your organization’s impacts on society, and the financial relevance of these impacts.

How to get clear view of how sustainability topics shape your financial performance:

1) Impact Materiality – Quantify your organization’s positive and negative impacts on society and the environment by obtaining the right information which informs the risk & opportunity assessment

2) Risk & Opportunity assessment – Use the impact materiality to understand which sustainability topics are, or will become, a risk or opportunity for the organization (i.e. financial effects)

3) Financial Materiality – Quantify in financial terms the sustainability topics that influence financial performance, both currently and in the future

4) (re-)Design Strategy – Determine the strategy that best matches your risks and opportunities

5) Monitoring & Reporting – Align materiality, management, and reporting to your strategic ambition, ensuring compliance and credibility

- Significantly reducing disclosure scope while addressing most sustainability risks

- Scoring on a scale that you choose:

- Impact materiality is assessed based on science-based thresholds for climate, water, nature, and social topics to your chosen cut-off

- Financial materiality is assessed based on the risk appetite of your CFO to the cut-off for financial materiality

- Integration of stakeholder perception and expert input

- Support in choosing the materiality definition that best suits your impacts, risks, and opportunity (IRO) profile and chosen sustainability strategy

- Tailored approach that best fits the maturity of your materiality processes

- Alignment with CSRD’s double and IFRS’s single materiality requirements

This ensures that your materiality assessment is not just compliant (if relevant), but meaningful. It helps you prioritize actions, allocate resources, and communicate with confidence.