Der PI Ansatz - Übersicht

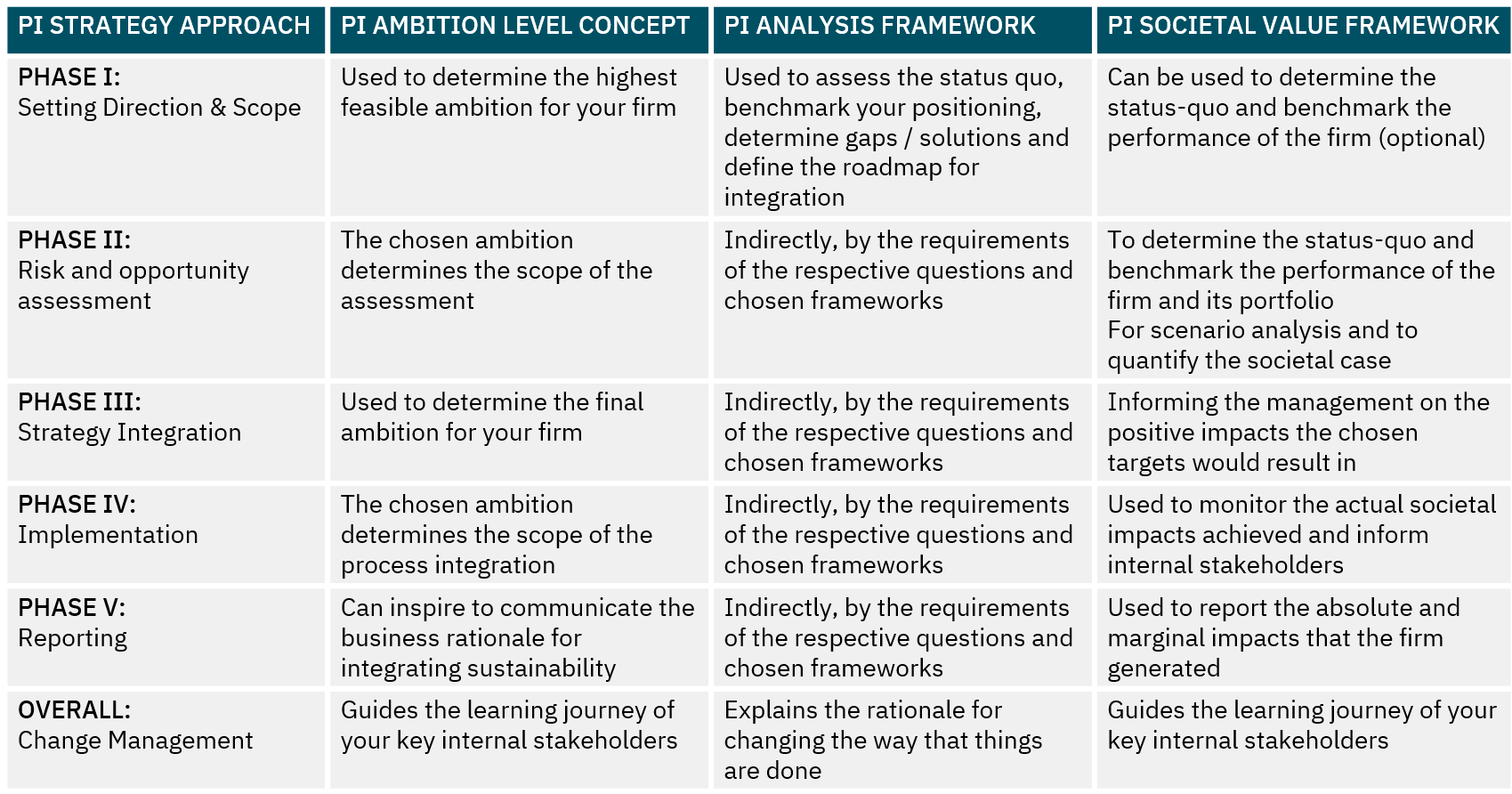

We are a strategy consulting firm that specialized in integrating sustainability/ESG into strategy and processes. That is why we have developed an science based appraoch featuring 5 Phases:

Overall goal of this phase: In this first step of the PI strategy approach, the company’s current and desired level of sustainability ambition is assessed and defined.

How we do it: With our PI Analysis Framework we assess the current level of sustainability / ESG integration in terms of strategy, operations, and reporting. We ensure the completeness of this sophisticated approach by mapping the 30 most recognized international sustainability frameworks to it. From “No Ambition” to “Sustainability Driven”, our framework defines five different sustainability / ESG management approaches. Both for companies in the real economy and the finance industry. We provide a complete perspective of your sustainability market positioning by assessing your status quo, competitors, customers, partners, investors, or targets.

Benefits for companies: Identify your current level of sustainability ambition, potential gaps, and overshoots to your desired ambition.

Additional Benefits for FS: Understand the desired ambition level of your capital providers, use the approach to identify targets, complement your due diligence, identify risks and opportunities for your current assets.

How we do it: Based on the ambition level(s) you would like to discuss with your management, we formulate the most relevant gaps and overshoots to develop measures for overcoming inconsistencies in the current management approach.

Benefits for companies: Discover in which areas of your current sustainability / ESG management you can become more competitive, i.e., effective and efficient, and define your integration roadmap.

Additional Benefits for FS: Uncover the risk and opportunities for your targets and current assets in terms of identifying risks and opportunities of the sustainability ambition and management. Use this information to complement your due diligence and as a basis for engagement during the ownership period.

How we do it: Based on the benchmark, status-quo, gap/overshoot, and solution assessment, we discuss the findings with the management, agree upon the highest feasible ambition, and discuss the scope of the assessment phase.

Benefits for companies: Get the top-management buy-in and clear scope for, e.g., a pilot for the assessment phase.

Additional Benefits for FS: Agree on the roadmap for integration and pilot assessments to further understand the sustainability / ESG risks and opportunities of the chosen product portfolio/business unit.

Overall goal of this phase: In this second step of the PI strategy approach, sustainability / ESG risks and opportunities for the chosen portfolio and possible measures are identified, evaluated, prioritized, and quantified in a scenario analysis. The ambition level selected determines the scope of the assessments.

How we do it: Based on a qualitative inside-out and outside-in analysis, we identify potentially material ESG issues, drivers and possible scenarios, and possible measures.

Benefits for companies: Identify and conduct an initial prioritization of potentially relevant impacts, dependencies, dynamics & possible measures.

Additional Benefits for FS: Understand the principle risk and opportunity categories and relevant time frames to consider in the scenario analysis for your asset(s).

How we do it: We survey and quantify relevant impacts, dependencies, dynamics in scenario analysis, and the effects of possible measures.

Benefits for companies: Understand the magnitude of sustainability / ESG risks and opportunities and the positive impacts of possible measures.

Additional Benefits for FS: Identify investment opportunities and understand the capital provision’s absolute and marginal positive impacts on your assets.

How we do it: We aggregate the findings of the previous steps, map them to the sustainability topics of our PI Topic Taxonomy and conduct a materiality analysis that fits the ambition level.

Benefits for companies: Understand which topics are material and why, understand their dynamics, and what is required by relevant frameworks to comply with future reporting requirements (if applicable).

Additional Benefits for FS: Understand which topics are material for your assets and why, understand their dynamics, and how your investments/engagement could positively impact the asset’s sustainability performance.

Overall goal of this phase: In this third step of the PI strategy approach and based on the desired ambition, the new strategy is defined including business model changes, ESG KPIs and target.

How we do it: We map the identified risks and opportunities with the current business strategy to identify gaps and discuss possible measures to integrate sustainability into the strategic planning.

Benefits for companies: Understand new or undervalued risks and opportunities of your current business strategy and how to deal with them.

Additional Benefits for FS: Understand how ESG impacts your asset(s) business strategy.

How we do it: In a workshop with the top management, we support the definition of the final ambition, ESG KPIs and targets, and decisions on changes to the strategy and business model/TOM.

Benefits for companies: Get the top management’s buy-in for a potential revision of the business strategy and business model and a clear agenda for your sustainability management.

Additional Benefits for FS: Understand which commitments and changes to the business model are considered feasible by the top management of your asset(s).

How we do it: We support the preparation of the integration into the strategic planning process and the design of the implementation strategy for changes in Governance structures and operations.

Benefits for companies: Ensure that the new structures and business models / TOMs are a fit for the chosen ambition level.

Additional Benefits for FS: Understand time and resource implications for the changes in the Governance and operations of your assets.

Overall goal of this phase: In the fourth step of the PI strategy approach, we aim for an integration into all relevant processes that is understood and supported by the middle management and provides the right incentives and abilities to track and monitor positive impacts generated.

How we do it: We support the definition of reporting lines and frequencies, board oversight and controls, and the integration into incentive schemes.

Benefits for companies: Ensure that the new Governance fits the chosen ambition level.

Additional Benefits for FS: Ensure that the necessary Governance structures are in place for your assets to manage ESG risks and opportunities properly.

How we do it: e support the implementation of a measure monitoring for all relevant functions to track progress and monitor achievements of the chosen measures. Connected to this is integrating sustainability / ESG into corporate finance, e.g., through the financing of selected measures.

Benefits for companies: Ensure that targets will be met and new insights gathered to inform the fine-tuning of measures and future planning process improvement. Achieve a “greenium” by quantifying the positive impacts for society that the respective investments will generate.

Additional Benefits for FS: Understand financing opportunities for your assets and how achieved positive impacts increase the value of your assets.

Overall goal of this phase: Ensure consistent communication to various stakeholders that fits your ambition level, reduces reputational risks and improves your ESG equity story.

How we do it: We support you in designing a reporting strategy for your most important stakeholders that complies with chosen/required reporting standards, while ensuring consistent communication that is free from “Only PR” approaches.

Benefits for companies: Ensure consistent communication that fits your ambition, reduces reputational risks, saves costs, and satisfies the information needs of your most important stakeholders.

Additional Benefits for FS: Understand how your assets’ sustainability / ESG reporting can be integrated into your reporting.

How we do it: We support you in designing an ESG Equity story and in identifying relevant ESG ratings that fit the chosen ambition. Furthermore, we support the identification of additional improvement potentials that match your ambition and help you engage with the rating provider on those requirements that do not fit.

Benefits for companies: Ensure a positive impact of your sustainability / ESG story on the valuation of your company and your cost of capital.

Additional Benefits for FS: Understand how the sustainability / ESG performance of your assets can increase the value of your assets.

Overall goal of this phase: In parallel to the five steps of the PI strategy approach, we aim for an integrated change process that identifies and addresses systemic issues.

How we do it: We support you in identifying and addressing systemic issues, tracking the value added of system changes, and communicating them to your internal stakeholders.

Benefits for companies: Ensure buy-in of top- and middle management by quantifying the business and societal case of your sustainability / ESG management.

Additional Benefits for FS: Ensure efficient and effective implementation of changes within your assets to ensure the achievement of set goals for your assets and quantify the business and societal case of your engagement.