Stategic Sustainability management pays off

Paper No. 1 of the PI paper series “Demystifying the links between sustainability/ESG and performance.”

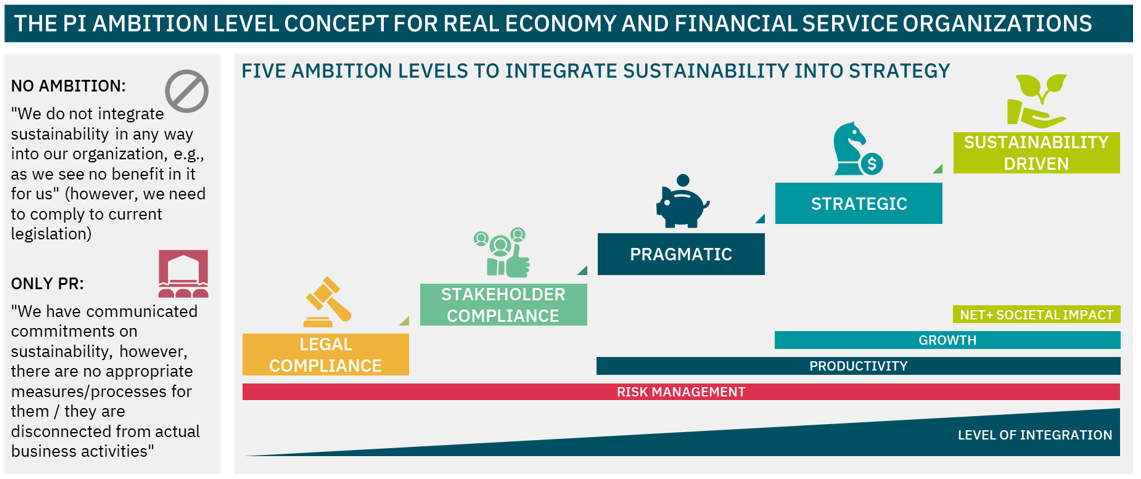

The paper introduces the first elements of the PI Approach – the PI Analysis Framework and the PI Ambition Level Concept – that form the basis for supporting companies and investors on their journey to integrate sustainability into strategy and processes. The Paper Series uses the metaphor of a hiking trip to stress that sustainability integration is not a question of choosing between two opposing options of being or not being sustainable. Instead, an organization should decide which sustainability “mountain” best fits their firm, i.e., which level of ambition in the sustainability integration best fits its business strategy. This cannot be a standardized exercise, as every organization needs to cope with different market conditions, strategic positioning, stakeholder demands, and regulatory environments.

Sustainability management is about strategic choices and integration into core business processes. It is a journey guided by four key questions: Where are you today? Where do you want to be? How to get there?, and What impacts do you generate on the way? The answers to these questions will be different for each organization, as the path to success might differ regarding sustainability management. The PI Analysis Framework answers the first question, while the PI Ambition Level Concept answers the second key question. These two elements are the research foci of the first paper[1].

With the help of the PI Analysis Framework, PI assesses the management approach of organizations. It consists of three dimensions, 20 criteria, and 40 questions to evaluate the state of integration of sustainability into the organization. It was designed and tested with the other elements of the PI Approach in more than 19.000 hours, including research and review of the requirements of 30+ frameworks, followed by an extensive peer-review that provided 200+ comments. It allows the creation of two scores: 1) the strategy score, which defines the position of an organization in the corresponding ambition level, and 2) the inconsistency score, which is the standard deviation of the strategy score and provides a measure of the quality in sustainability management. In addition, the PI Ambition Level Concept defines five distinctive strategic imperatives (ambitions) that can be plausible for any organization in the journey of sustainability integration into the business processes.

© positive impacts (PI) GmbH (2022)

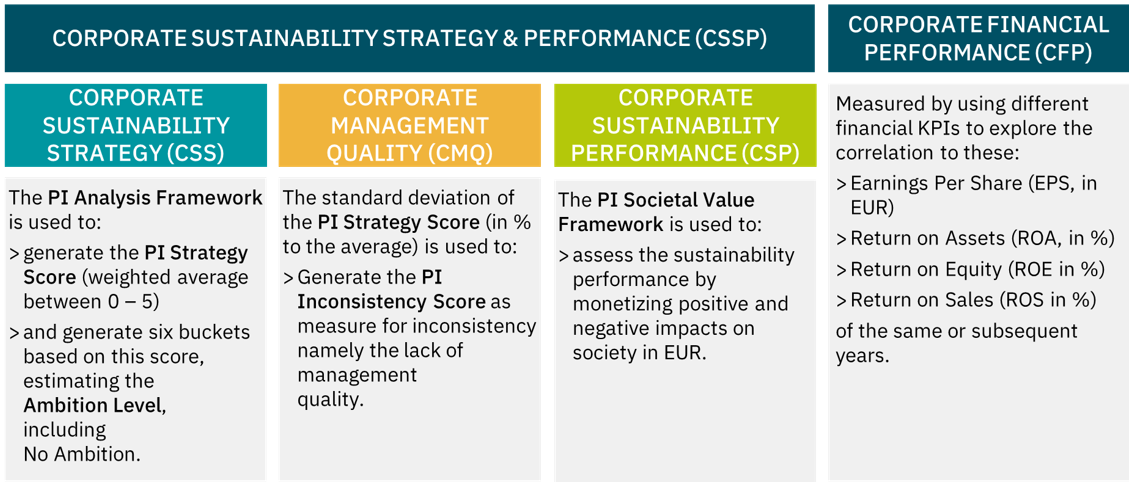

The PI Approach consists of four interlinked frameworks and concepts that aim to guide companies and investors on how to integrate sustainability into strategy and operations. In addition, it allows conducting assessments on the links between sustainability in business and financial performance by assessing the Corporate Sustainability Strategy & Performance (CSSP) and its relation to corporate financial performance (CFP). The innovation in the CSSP structure is the differentiation between sustainability management, management quality, and sustainability performance, and the relation of each one of these components with an organization’s financial performance. This was tested using the largest 100 companies listed in the German Stock Market as a study sample (called N100) for pre-covid times (i.e., years 2018 and 2019).

© positive impacts (PI) GmbH (2022)

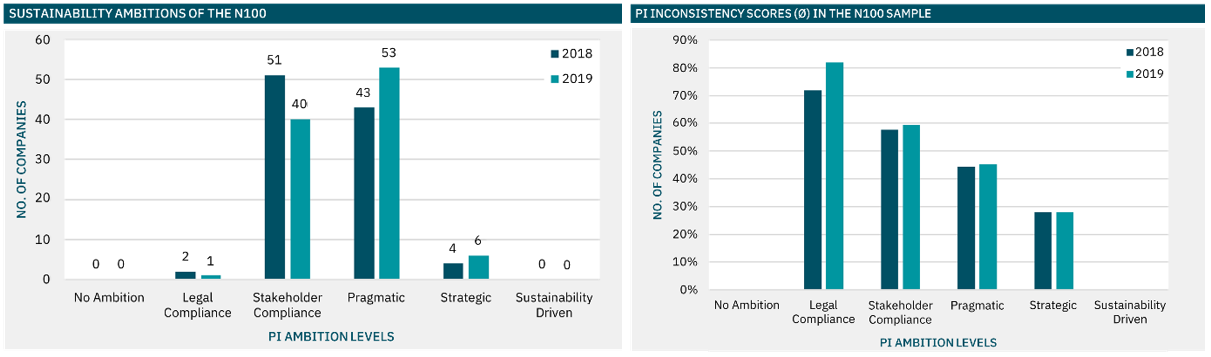

The results show that no company in 2018 nor 2019 was Sustainability Driven, but all companies had a certain level of ambition in their sustainability strategies. Most companies were classified as Stakeholder Compliance and Pragmatic. In addition, it was observed an increase in the ambition level from one year to the next one.

© positive impacts (PI) GmbH (2022)

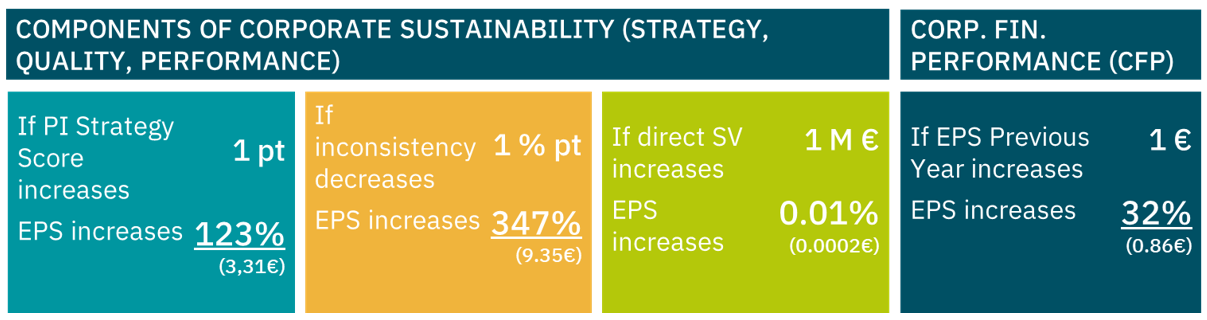

In a statistical model, the CSSP components were used as explanatory variables of the Corporate Financial Performance (CFP) measured as Earnings per Share (EPS, ranging from -5 to 24 €). The results of a multiple regression model show a significant positive effect of CSSP components on CFP: The Relative Importance analysis showed that CSSP could explain 20-29 % of the EPS overall. The simple regressions showed that a 1 pt. increase in the PI Strategy Score led to a 123 % increase in EPS (€3.31); a 1% decrease in the PI Inconsistency Score resulted in a 347% increase in EPS (€9.35), and a 1% increase in SV resulted in a 0.01% increase in EPS. However, the EPS of the previous year also explained the EPS: a 1 € increase led to an increase in EPS of 32 % (0.86 €), representing all residual factors that drive EPS.

© positive impacts (PI) GmbH (2022)

The paper also examined the question if the financial performance drove sustainability ambition and management. However, its effect is neglectable: the sustainability ambition and management quality were explained by less than 7% by the previous year’s performance. Thus, sustainability ambition and management quality are strategic choices rather than the result of previous financial performance.

The results lead to the conclusion that choosing a higher strategic ambition and managing it consistently is related to improved financial performance. Furthermore, Societal Value is also positively correlated to better financial results, however, to a smaller extent. Therefore, a consistently implemented sustainability strategy pays off.

This work was supported by B.A.U.M. e.V., and by the former Value Reporting Foundation (VRF, now consolidated with the IFRS Foundation in support of the International Sustainability Standards Board, ISSB) and the Institutional Shareholder Services group (ISS ESG) with free research licenses and data.

[1] A detailed explanation of the third and fourth questions can be found throughout the three PI papers. Get access to the whole paper series here.