“You can print money, but you cannot print time” (M. Viehöver)

…as time needs to be invested wisely to achieve sustainable economies. Why?

Business’s positive economic impact on society is more and more devalued by negative environmental, social, and governance (ESG) impacts. Climate change, biodiversity loss, and preventable health costs are some of the most evident societal issues: We need to act now to prevent significant further losses to societal value and start a change that leads to improving it.

As a result, stakeholder expectations and legal requirements for businesses and investors to handle sustainability topics are increasing. In turn, this could either lead to material risks or to attractive opportunities for all actors. A sustainability strategy which is not aligned with the overall business strategy lacks the potential to manage risks and seize respective opportunities. Such a rather disconnected CSR or ESG approach will also risk reputational damage among your most important stakeholders: employees, business partners, and clients. They are the first ones to notice inconsistencies between external communication and actual practices.

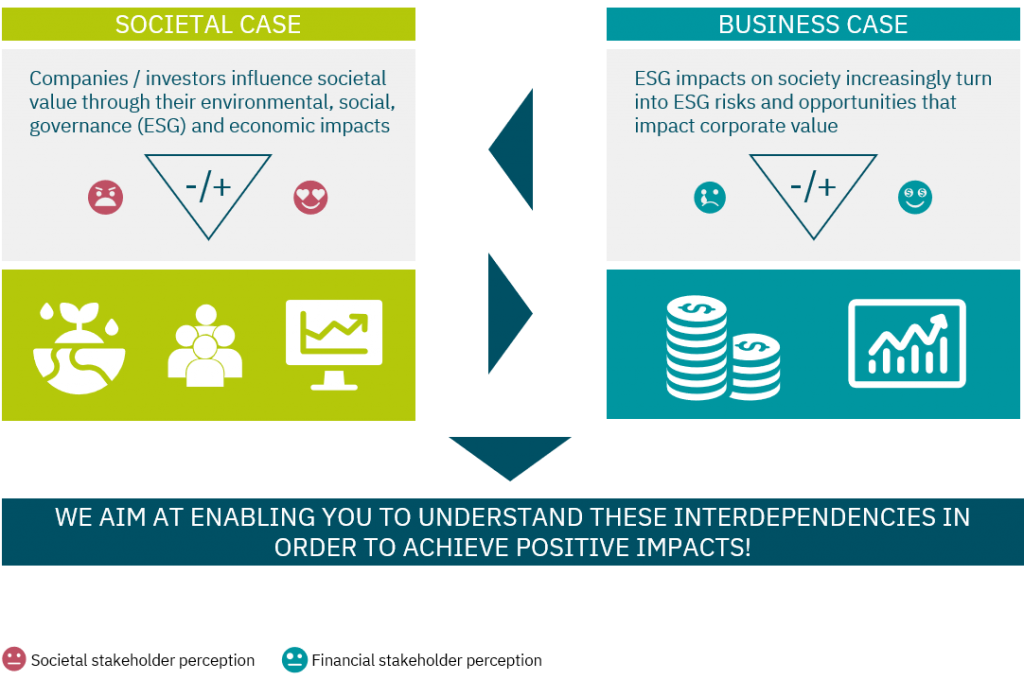

In our view, the integration of sustainability / ESG into your strategy should aim at generating net positive impacts as much as possible , balancing the societal and business cases:

Societal case: an organization’s activities (negatively/positively) impacts…

- the environment (e.g., through emissions/improved biodiversity)

- the people (e.g., through causing preventable health costs/offering training & education)

- the economic value added (e.g., by corruption/creating jobs and infrastructure)

Sustainability integration, market dynamics and stakeholder responses can also influence the business case:

- Impact on profits (e.g., through reduced costs/higher market share)

- Impact on company valuation (e.g., cost of capital)

In our experience, consistently managing these impacts cannot be based on a one-size-fits-all approach as offered by most ESG (rating) frameworks. The PI approach is designed to adjust to your ambition and business context. That is why we do not dictate a single “right” way towards sustainability. Instead, we guide you to what fits best to your strategy to aim at increasing business and societal value.

See how“In my nearly three-decade long career, I have held management positions in some of the top global consulting firms, including KPMG, Deloitte and AECOM (formerly URS) as well as leading positions in civil society organizations organizing youth projects with the Club of Rome and other renowned youth organizations. I have initiated and successfully led projects with global companies, investors, insurers and organizations as well as mid-sized companies to support them in advancing the ESG integration into strategies, processes and valuations.

My knowledge and experience, combined with a profound understanding of the limitation of predominant ESG approaches, have led me to founding positive impacts (PI). I work with other experienced experts to fully exploit the potential of integrated sustainability strategies, powered by the approaches and innovative frameworks I have designed and tested. So here I am, building positive impacts by fueling successful sustainability / ESG integration for companies, investors and organizations just like yours.”