WHAT’S MATERIAL?!

DOUBLE MATERIALITY IN THE AREA OF CONFLICT BETWEEN IMPLEMENTATION AND STRATEGY.

Paper No. 2 of the PI paper series “Demystifying the links between sustainability/ESG and performance”

Materiality is a decision-making process in which an entity decides what is material for its venture and why it is defined to be material. That is also why materiality is an essential aspect of integrating sustainability into strategy, which is not a one-size-fits-all exercise. The concept of materiality is also part of corporate reporting, both financial reporting and sustainability reporting. In the latter, there are up to three dimensions: Impact on society (“inside-out”), impact on business (“outside-in”), and stakeholder perception. The study explains to what extent these are part of various standards and how they can be measured.

Furthermore, in a case study on the 100 biggest stock listed companies in Germany, the paper showcases an approach to assess Impact on Society, by applying the monetization of externalities to assess the value chain Impact on Society. Three main questions were subsequently assessed: To what extent is the company’s judgment on Impact on Society congruent with a monetized approach? To what extent do the judgments by the companies and SASB topics (on industry level) regarding the Impact on Business differ? To what extent can stakeholder perception be seen as a proxy for another dimension? In addition, the study assessed the relationship between the double materiality preparedness and the PI Ambition Levels of the N100 companies.

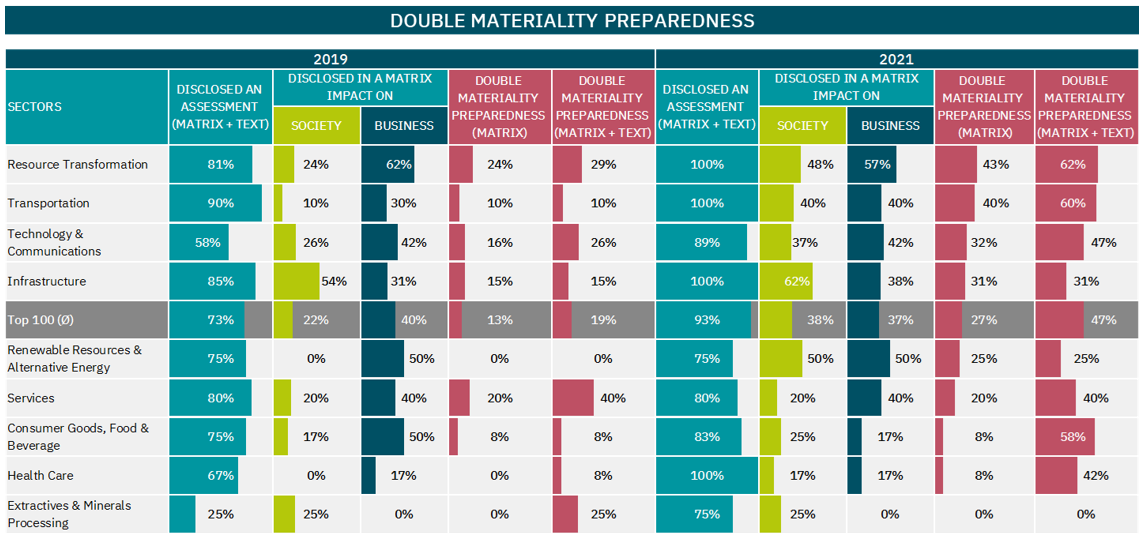

The results show that in 2019 only 13% of the companies disclosed the dimensions Impact on Society and Impact on Business so that they can be seen as double materiality prepared. This number increased to 27% in 2021 or 47% when self-reported statements are also accepted. No company in 2019 and only one company in 2021 was double materiality ready by applying the double materiality definition. On average, only one-third of companies disclosed Impact on Business or Impact on Society results. Furthermore, in 38% of cases, the results on sector level presented a mismatch of the average Impact on Society assessment compared to the monetization approach. In 29% of the cases, the average company assessments do not align with the SASB Standards topics for its industry. It is also shown that the stakeholder perception leads to very different outcomes when comparing the results with the Impact on Society judgments.

© positive impacts (PI) GmbH (2022)

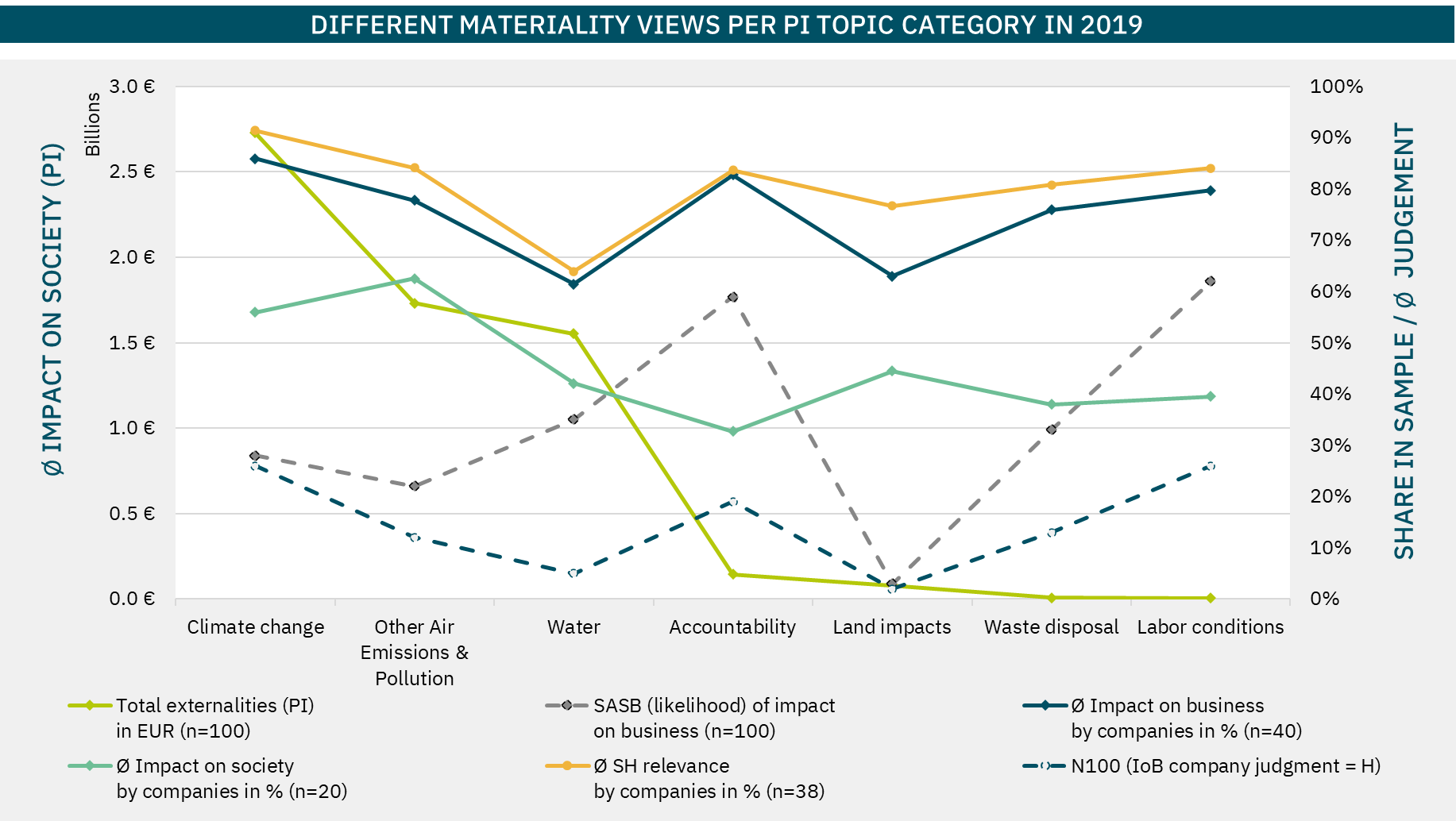

A comparison of the relative importance assigned to the two dimensions shows that companies, on average, tend to judge the impact on business as more important than their impact on society. All topic categories were judged to have a moderately high impact from the outside-in perspective but at the same time were judged to have a moderately low impact from the inside-out perspective[1]. In addition, stakeholder perception was rated highly important and followed the same pattern as the impact on business. The company’s judgments clearly show a high correlation between impact on business and stakeholder perception (0.49), while it was significantly lower between stakeholder perception and impact on society (0.24) and lowest between the impact on business and impact on society (0.06). Thus, stakeholder perception cannot be seen as a proxy for impact on society but rather as a proxy for the impact on business in the form of a reputational risk indicator in the sample. The lack of clarity on how companies assess the impact on business, in combination with the high correlation with the stakeholder perception score, suggests that stakeholders’ perception mainly guided their impact on business judgment.

© positive impacts (PI) GmbH (2022)

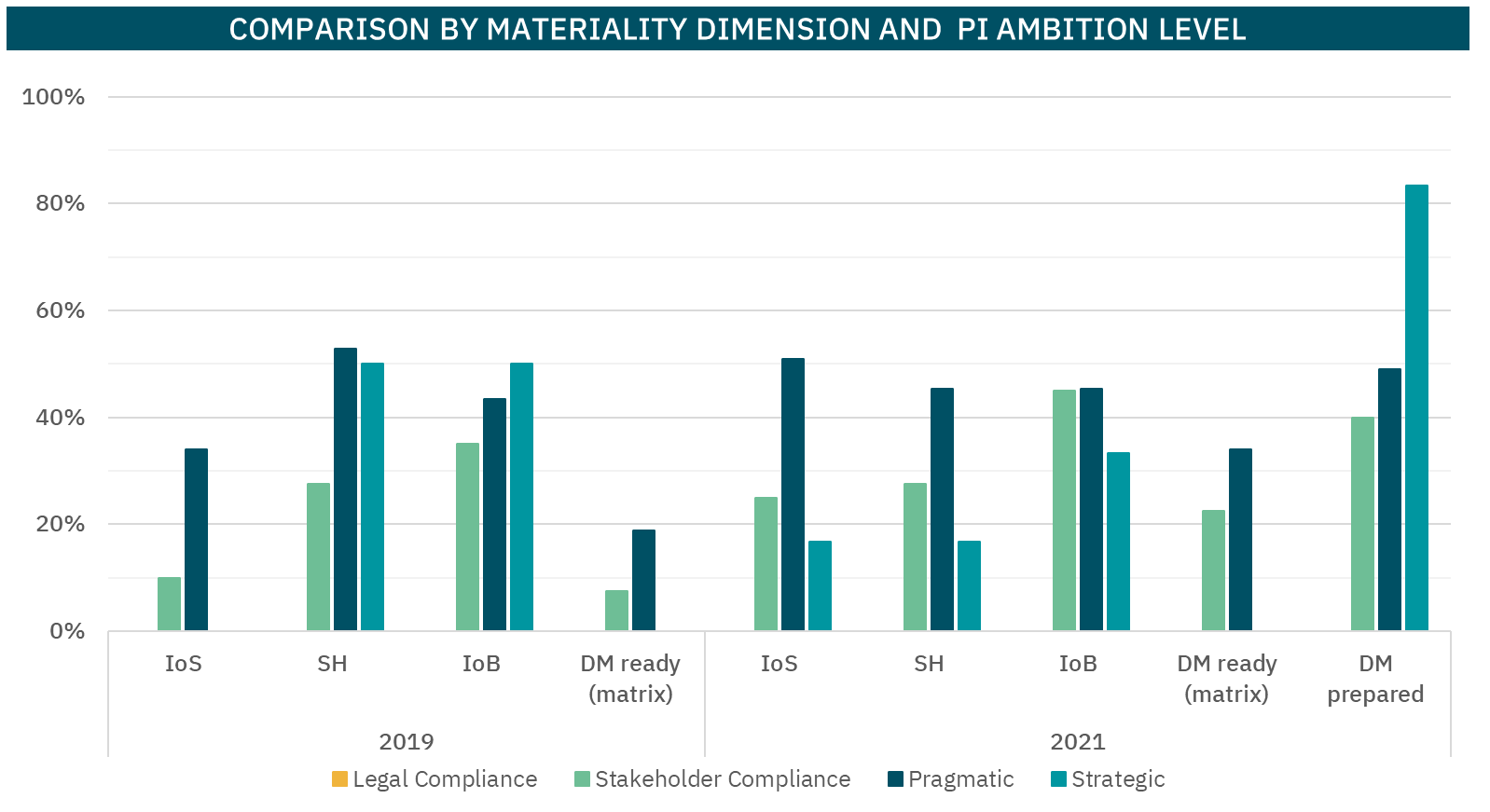

The analysis of materiality disclosures by ambition level[1] showed that during 2019 only 19% of Pragmatic and 8% of Stakeholder Compliant companies disclosed double materiality dimensions in a matrix format, meaning that the rest either did not analyze both dimensions or they were ambiguously disclosed throughout the text. The same companies did so in 2021 with a higher rate (34% and 23%, respectively). However, it was decided to include for 2021 the double materiality disclosures presented as matrices or text in sustainability reports for comparison reasons. Surprisingly, Strategic companies reached a share of 83%, while Pragmatic and Stakeholder Compliant companies also increased their share notably (49% and 40%, respectively). The numbers suggest a possible relation between the sustainability ambition and the assessment of materiality dimensions, as well as double materiality preparedness, and can indicate the grade of integration of the materiality assessment within the overall company sustainability strategy. However, it is unclear why Strategic companies with a higher level of sustainability integration did not disclose double materiality dimensions or materiality unambiguously. This may be explained only by their low share in the sample.

© positive impacts (PI) GmbH (2022)

The study confirms that the materiality assessment is company-specific and depends on the applied approach and value chain scope. Moreover, the results suggest a plausible relation between the chosen sustainability strategy and the sophistication of the materiality assessment. This entails the need for a flexible standard for the concept of double materiality. PI therefore recommends standard setters to offer two alternative materiality definitions (single and double materiality). This is more useful from a societal perspective as imposing one definition may induce more “Only PR” approaches. However, PI recommends standard setters to require the disclosure of a materiality matrix with both dimensions to improve comparability and transparency, while giving some form of flexibility on how these dimensions are assessed. Stakeholder perception should, in this context, not be accepted to assess Impact on Society. Furthermore, instead of imposing “double materiality”, it may be more feasible for policy makers to require companies to report a limited number of performance indicators for specified value chain activities to their customers. Such information would be much more “decision useful” for a customers, investors, and society as a whole.

[1] Additionally, there are noticeable fewer companies assessing Impact on Society than assessing Impact on Business or stakeholder perception.

[2] The Paper No. 1 makes a detailed explanation of the five strategic imperatives of sustainability integration, also called as sustainability ambition level

Fill out the form to receive a free download link to our paper !