“Demystifying the links between sustainability/ESG and performance” Summary of the results of the PI Study Series

What has long been suspected has now been quantitatively proven: a double dividend from sustainability is possible, but it is not a given! This innovative Study Series demystifies the links between sustainability management, financial performance, and sustainability performance using public information of the 100 largest companies listed in Germany (N100). The results indicate that poor sustainability management reduced corporate and societal value and good management created a double dividend. To arrive at this conclusion, the pilot study also tested a newly developed approach for evaluating sustainability strategy, sustainability management quality, and sustainability performance.

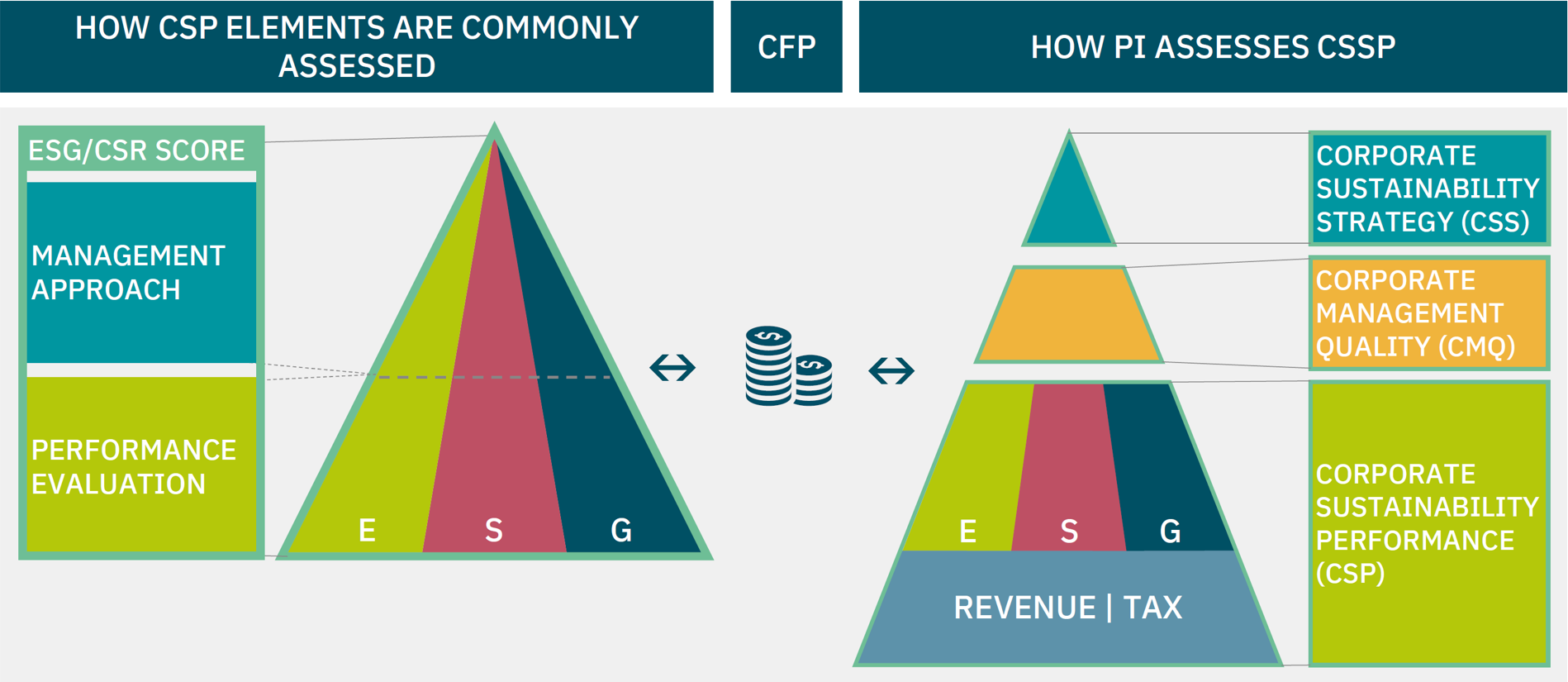

Over 3,000 studies worldwide on the relationship between corporate sustainability and financial performance evaluate corporate sustainability in a score that includes its management and performance as “corporate sustainability performance” (CSP), which means that all companies are evaluated against one pre-defined management approach. On the contrary, this study acknowledges that sustainability management will differ driven by competition, strategy, and ambition and suggests only assessing sustainability performance in a standardized way. Therefore, the sustainability strategy and performance assessment was evaluated differently and separately. In addition, the new approach made it possible to assess sustainability management quality. These three distinct variables covering Corporate Sustainability Strategy and Performance (CSSP) were then assessed regarding their influence on the sample’s corporate financial performance (CFP). For the qualitative assessments on the management approach alone, 8,000 data points were generated and reviewed using a three-step quality assurance process. In reverse, the influence of sustainability strategy, management quality and financial performance on sustainability performance was also assessed.

© positive impacts (PI) GmbH (2022)

Determination and evaluation of the sustainability strategy and management quality

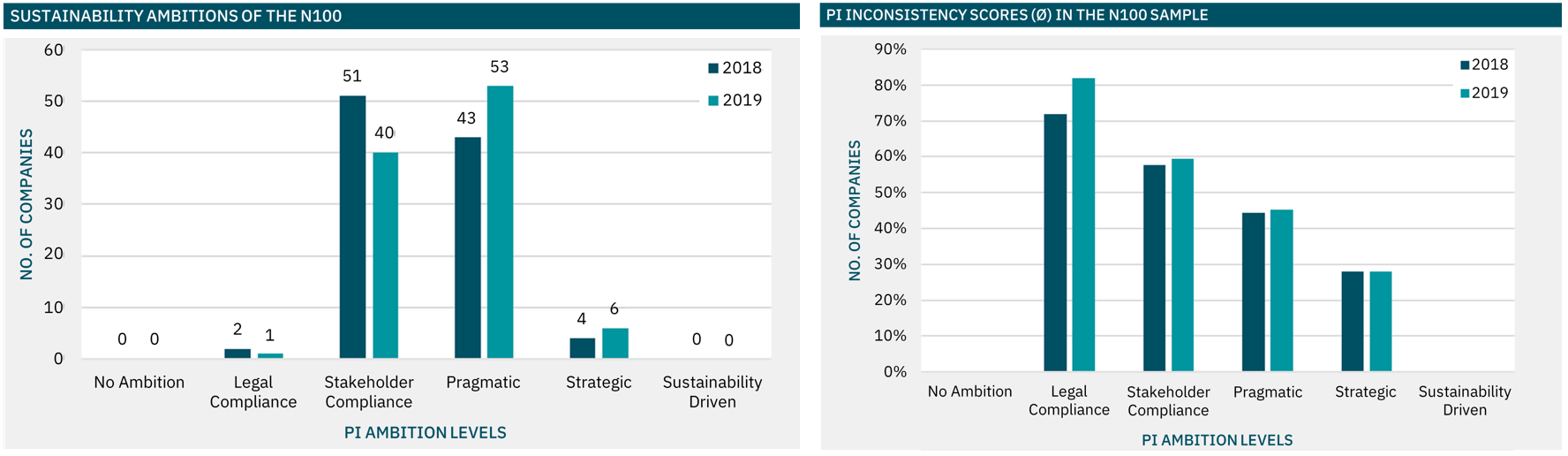

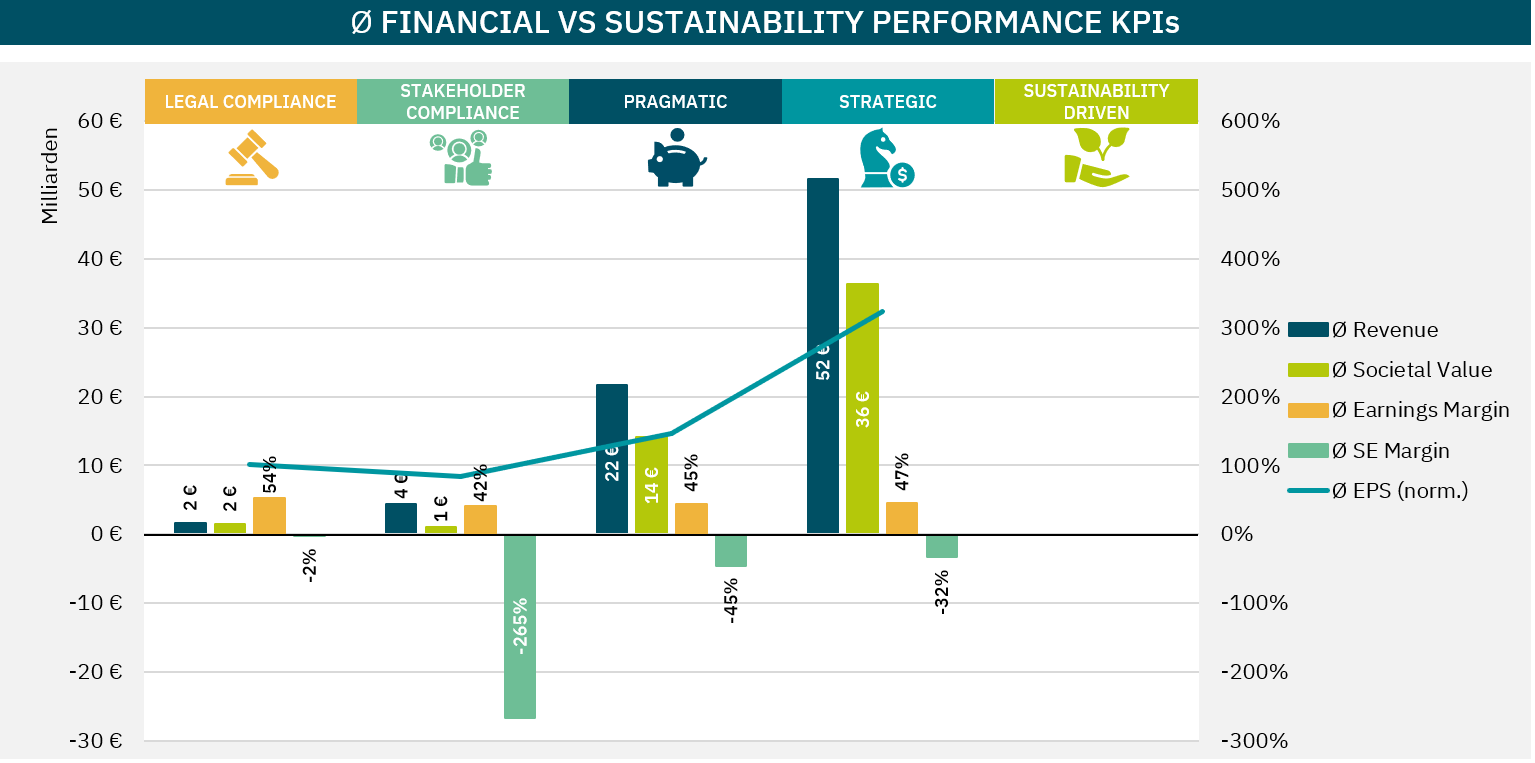

With the help of the newly developed PI Analysis Framework, PI assessed the management approach of the N100 companies. This framework generates two scores: 1) the strategy score, which defines the strategic imperative of the management approach of an organization (also called ambition level), and 2) the inconsistency score, which provides a measure of the quality of sustainability management. The basis for this approach is the PI Ambition Level Concept which defines five distinctive strategic imperatives (ambitions) that can be plausible for any organization in the journey of sustainability integration into business processes. The results show that no company in 2018 nor 2019 was Sustainability Driven, but all companies had a certain level of ambition in their sustainability strategies. Most companies were classified as Stakeholder Compliance and Pragmatic. In addition, it was ovserved an increase in the ambition level in one year.

© positive impacts (PI) GmbH (2022)

A consistent and ambitious sustainability strategy pays off

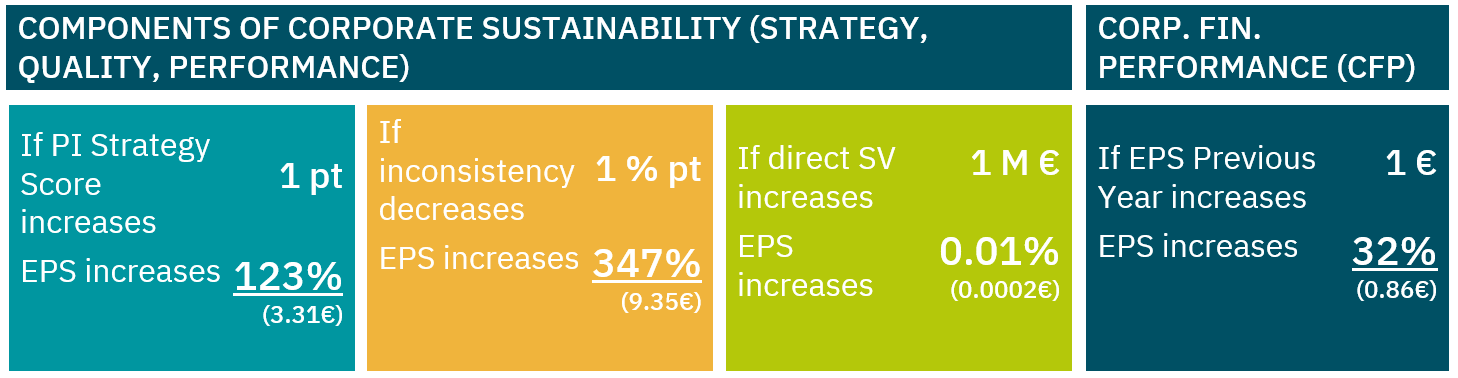

The statistical model confirmed that companies with consistent and ambitious sustainability management achieved better financial results and that overall, 20% to 29% of financial performance was attributable to sustainability strategy and performance. Here, various financial KPIs showed this positive correlation, with earnings per share (EPS) being the most striking. EPS had a range of -5 to +24 € in 2018 and a change to 2019 of -512% to +1,760% over this period. On average, a 1-point increase in PI Strategy Score (Ambition Level) led to a 123% increase in EPS (€3.31); a 1% decrease in PI Inconsistency Score (Management Quality) led to a 347% increase in EPS (€9.35), and a 1% increase in “Societal Value” led to a 0.01% increase in EPS. Of particular interest is the fact that these results were highly statistically significant and even independent of company size, sector, and year.

© positive impacts (PI) GmbH (2022)

Double materiality, in the area of conflict between implementation and strategy

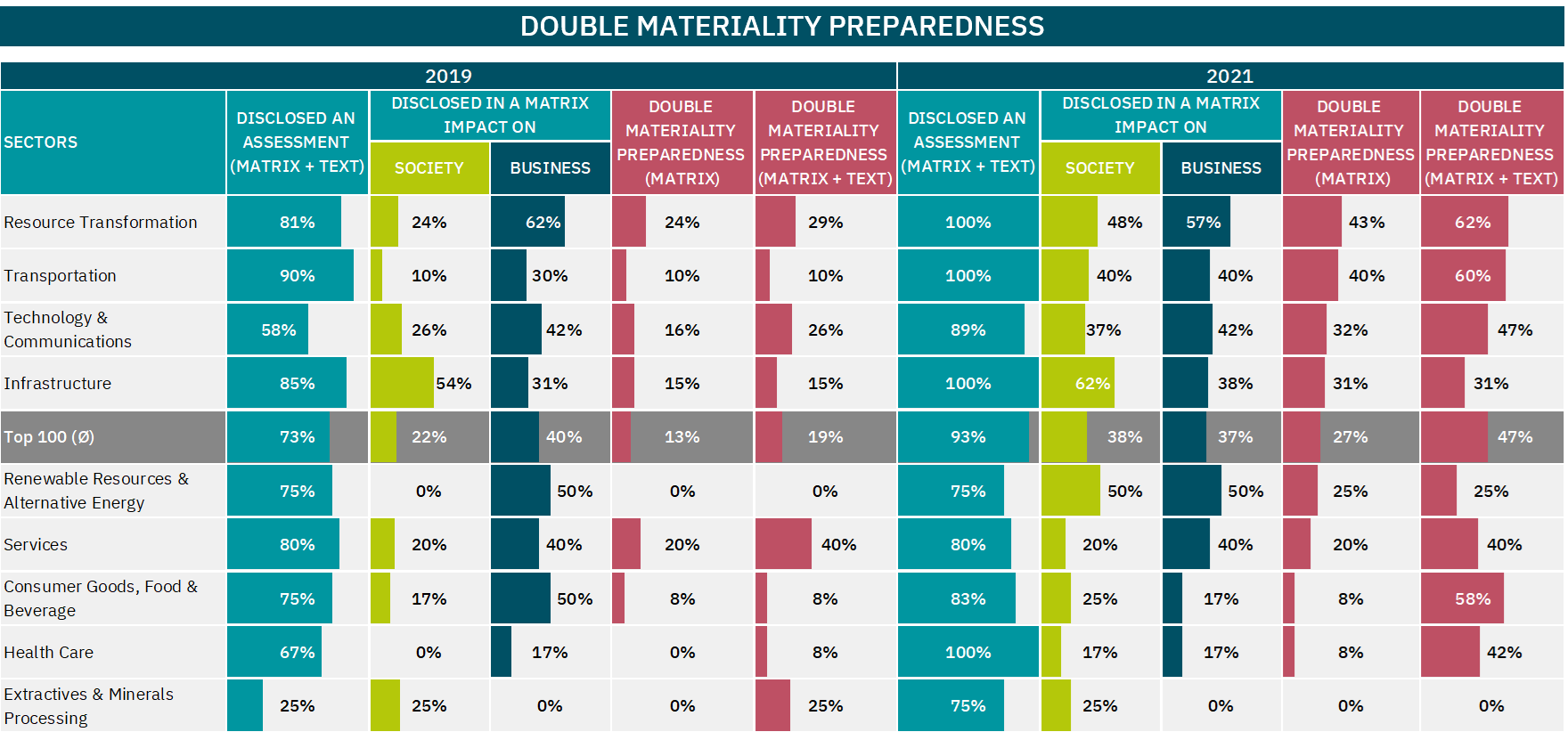

The second paper deals with the concept and application of materiality as an essential aspect of integrating sustainability into strategy. It examined three popular dimensions used in materiality assessments for the analysis: Impact on Society (“inside-out”), Impact on Business (“outside-in”), and Stakeholder Perception.

The study used the monetization of externalities to compare calculated outcomes with available judgments of Impact on Society. In addition, the likelihood of a topic to be determined as material at the industry level by SASB was compared with available judgments of Impact on Business. In addition, the study assessed the double materiality preparedness and its relationship to the PI Ambition Levels of the N100 companies.

The results of the impact on society quantified by PI differed, in some cases significantly, from the companies’ assessments. There were also some major differences in the assessment of business relevance. Of particular interest is the low correlation between the average stakeholder assessment (SH) and the impact on society on the one hand and its high correlation with business relevance on the other. The latter suggests that companies see sustainability primarily as reputation management without properly assessing other impacts on business.

Finally, conceptual challenges of the EU approach to double materiality were identified. The approach seems to be in conflict between implementation and strategy: Only one of the companies assessed applied double materiality in 2021. The rest ultimately applied single materiality or another materiality definition.

In the future, 50,000 companies in the EU and 15,000 German companies will be required to follow an approach applied by a single company of the N100, which, according to PI analysis, can be classified between Stakeholder Compliance and Pragmatic ambition level. This is also the reason why PI proposed that the ISSB and EFRAG should offer both single and double materiality and define certain mandatory KPIs, independent of any materiality assessment by the companies.

© positive impacts (PI) GmbH (2022)

On track to net positive? How companies create value

The PI Societal Value (SV) Framework is introduced in the third paper as an innovative approach to measuring the societal value companies create or diminish to society. It assesses the overall sustainability performance of organizations by netting financial baselines with monetized impacts on society (i.e., positive and negative externalities). The PI SV Framework consists of two main KPIs: the Societal Value (SV) as a mirror for revenues and the Societal Earnings (SE) as a mirror for earnings froma a societal perspective. Furthermore, the Societal Earnings Margin builds the ratio of the two (SE/SV), called SE Margin. Their novelty lies in avoiding impact washing (creative accounting of impacts, e.g., double counting of positives) and defining financial baselines that fit the value chain scope of the respective societal impacts. The conception of the PI SV Framework avoids mixing absolute and marginal impacts and considers only absolute ones in its calculation.

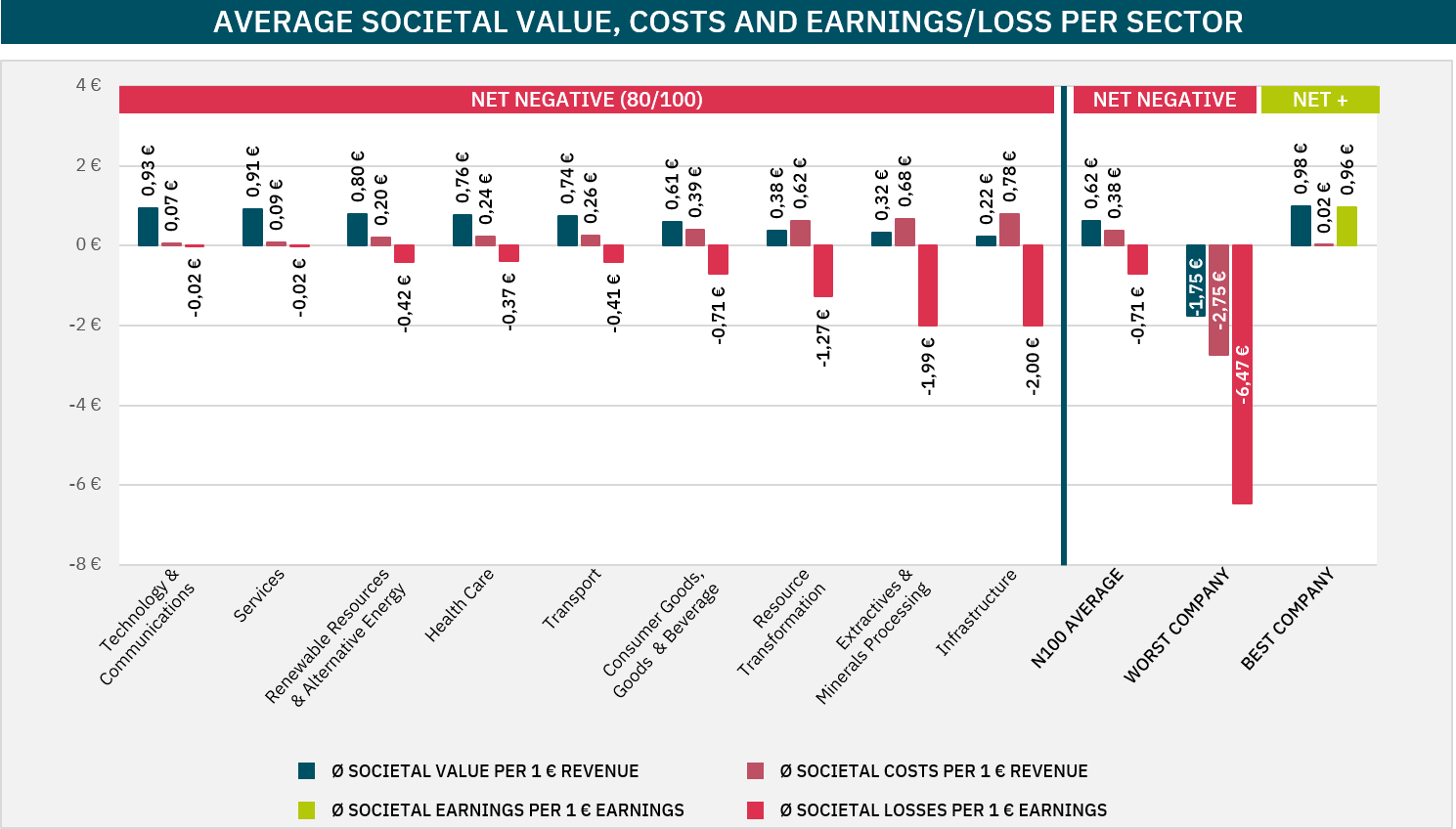

The results indicate that, on average, all companies created a SV of 62 Euro cents for each Euro revenue in 2019; the rest (38 Euro cents for one Euro in revenue) was eroded as Societal Costs. On the contrary, the average SE was -71 Euro cents for every Euro earned along the value chain, meaning they created a Societal Loss. However, 20 companies from various sectors generated Societal Earnings, as the taxes paid were higher than their externalities, i.e., they were net positive. The best company generated 96 Euro cents of Societal Earnings for each Euro earned along the value chain. The worst created a Societal Loss of 6.47 Euro for each Euro earned. Both companies came from the worst performing sector: Infrastructure.

© positive impacts (PI) GmbH (2022)

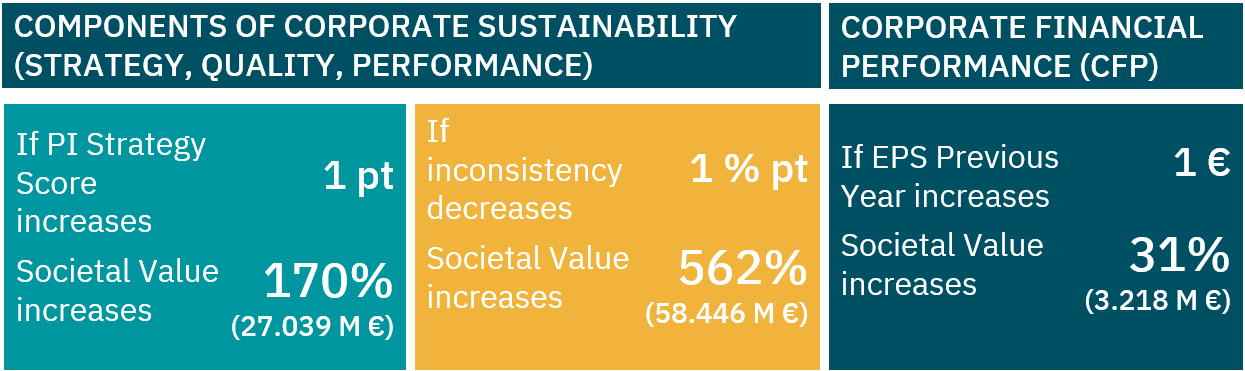

The previous results combined with the PI Ambition Level Concept show that SV, sustainability strategy, and management quality are positively related. A statistical model proved that increasing the integration of sustainability in the business strategy (increasing ambition level) and improving management quality (increasing consistency) resulted, on average, in an increase in Societal Value of 170 % (27 billion Euros) and 562 % (58 billion Euros) respectively (sample range: -25 billion € to 155 billion €). The company’s financial performance measured as Earnings per Share of the previous year increased the Societal Value by only 31 %.

© positive impacts (PI) GmbH (2022)

The double dividend of sustainability/ESG, a fairy tale? Well, it depends!

In summary, companies with higher ambition levels and more consistent management approaches presented significantly higher revenues, higher profits (EPS), higher Societal Value, lower negative Societal Earnings Margins, and even slightly higher private Earnings Margins. These results indicate that an ambitious and consistent management approach creates a double dividend: value for society and the shareholders. However, ultimately, a positive SE Margin should be the goal next to a related positive Societal Value, as 20 companies in the sample were able to achieve.

In the two perspectives, the business case and the societal case of sustainability management, its consistency and ambition showed the strongest influence in the simple regressions. Both linear trend lines show that inconsistent and unambitious sustainability management approaches lead to negative profit (EPS) and low “Societal Value”. Consistent and ambitious sustainability management approaches, on the other hand, led to positive profit and “Societal Value”. In other words, poor sustainability management reduced corporate and “societal value,” while good sustainability management created a double dividend.

© positive impacts (PI) GmbH (2022)

The Study Series proves why sustainability should not be treated as a regulatory/compliance-driven activity isolated from the overall business strategy. It was proven, that companies implement different sustainability management strategies and that the level of sustainability integration into business processes, the management quality, and sustainability performance are interrelated and have a positive relationship with the company’s financial performance. Moreover, increasing sustainability integration and management quality improves financial and sustainability performance. Therefore, an integrated sustainability strategy produces double dividends. Finally, the results are put into context for various stakeholder groups to provide implications for companies, investors, regulators, and society. Further, recommendations are formulated on how other mechanisms apart from regulatory frameworks could be developed to incentivize companies to apply holistic sustainability strategies and avoid “Only PR” approaches.

The Study Series was supported by B.A.U.M. e.V., and by the former Value Reporting Foundation (VRF, now consolidated with the IFRS Foundation in support of the International Sustainability Standards Board, ISSB) and the Institutional Shareholder Services group (ISS ESG) with free research licenses and data.

Get the full study paper series “Demystifying the links between sustainability/ESG and performance” for free here.